Shopify: artificial intelligence leader in Canada

Editors Note: This is the fourth and final installation of a special feature on Artificial Intelligence from a Canadian perspective that is brought to you courtesy Industrial Alliance Securities and analyst Blair Abernethy. For part one click here and follow the links to the next part.

In what follows, we hope to provide readers with a view into the potential application and impact of AI technologies on several of the enterprise software companies that we cover. In our discussions with R&D and business leaders at these companies, we focused our questions as follows:

1. What, if any, AI technologies are deployed within your product offering today?

2. What are the key areas of opportunity to incorporate AI into your product roadmap in the next two years?

3. How could AI impact your product value proposition in the near future?

The companies we spoke to that are actively pursuing the incorporation of AI technologies into their enterprise software product offerings include (by order of market capitalization): Shopify (SHOP-Q, US$94.61, Buy, Target US$105.00), OpenText (OTEX-Q, US$32.48, Buy, Target US$37.50), Kinaxis (KXS-T, C$69.56, Hold, Target C$73.00), Absolute Software (ABT-T, C$7.97, Buy, Target C$11.00), Symbility (SY-T, C$0.43, Buy, Target C$0.70), and ProntoForms (PFM-T, C$0.40, Speculative Buy, Target C$0.75).

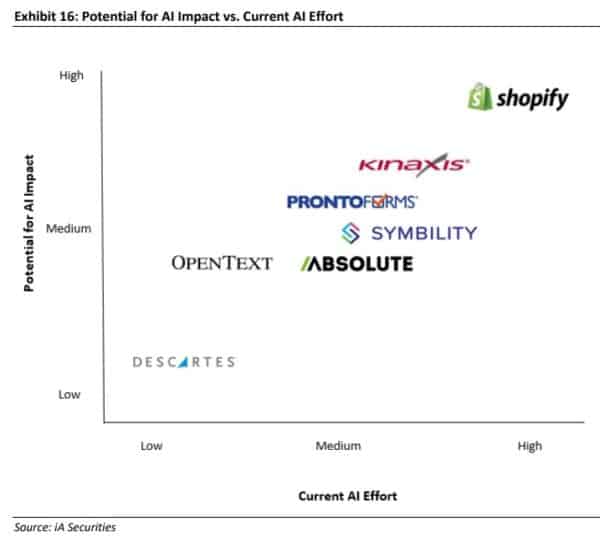

At this juncture, in terms of impact to their overall businesses and product offering value proposition, we believe that Shopify, Kinaxis, and ProntoForms could see meaningful positive impacts from the incorporation of AI technologies within the next two years. We expect a more modest but still positive impact to the current and future product offerings for both Absolute Software and Symbility.

Given the size of the business and wide range of products, we expect AI to have a somewhat lower impact on OpenText’s overall business performance (i.e., revenue growth) in the next two years. While we believe Descartes Systems (DSGX-Q, US$27.30, Hold, Target US$24.00), particularly given its GLN and SaaS-based routing/scheduling product offering, does has an opportunity to incorporate AI into some of its products, we understand that the Company is still evaluating and formulating its strategy with respect to AI and we do not expect the Company to substantially ramp up its AI development spending efforts this year. It is important to note that both OpenText and Descartes’ products generate and store significant amounts of structured and unstructured customer and operational data. In time, we believe that these data stores could be drawn upon for new AIenhanced functionality and applications, increasing both the stickiness of OpenText and Descartes’ solutions and potentially creating new revenue streams.

Of course, given the rapidly evolving nature of AI technology, future changes in corporate product strategies, and technologydriven M&A, our assessment of AI’s impact on these particular software vendors will clearly be subject to change over time. In this report, we merely attempt to provide a snapshot of the current state of AI-related development efforts and a near-term outlook. It is our intent to track and revisit the progress that our covered companies make in incorporating AI into their products and the adoption of these new features by end-customers in the future.

OpenText (OTEX-Q, US$32.48, Buy, Target US$37.50)

We believe that OpenText is in an interesting position to potentially benefit from recent advances in AI, particularly in light of its very large installed base of structured and unstructured enterprise content management solutions.

Up until the last year, we believe that OpenText paid relatively little attention to AI technology. In July 2017 at its annual user conference, OpenText formally announced the launch of Magellan™, a newly created AI platform. Magellan™ is a highly customizable and scalable platform that combines open source machine-learning technologies with advanced analytics and enterprise level BI. Magellan™ incorporates semantic search engine and text mining analysis technology from its Nstein (acquired 2010) business, as well as components from the Actuate (acquired January 2015) BI and analytics product set. OpenText’s Magellan™ platform is expected to be able to process massive amounts of structured and unstructured data and

can enable the end user to use advanced analytics, machine assisted decision-making, and deep automation. While Magellan™ has just been introduced, we note that there was significant customer interest in the new product offering at the July user conference.

In terms of opportunities for OpenText, we believe that the Company’s large installed base of primarily unstructured data management applications puts it in a very good position to provide source data for AI projects. We will be watching to see if OpenText customers and partners begin to incorporate machine-learning assisted solutions over the next few years. We think that the Magellan™ platform could help customers derive more value from their investments in OpenText’s ECM products and their associated unstructured data repositories. We believe that, over time, OpenText should be able to capture additional product and service revenue by leveraging AI, as well as potentially increasing the stickiness of its large installed content management maintenance base. Furthermore, we note that OpenText recently closed the acquisition of Covisint (COVS-Q, Not Rated), which provides it with a more robust product offering in the IoT market. We note that IoT has become much more closely tied to AI/machine-learning technology given the need to build solutions that can utilize and leverage the massive data flows that IoT projects can produce.

Shopify (SHOP-Q, US$94.61, Buy, Target US$105.00)

Shopify has long recognized the importance of using customer and operational data generated on its e-commerce platform to measure, understand, and improve upon the services it offers. We view Shopify as an enthusiastic and early adopter of AI technology and expect the Company to continue to rapidly develop and acquire complementary AI components to further improve its offering over the next year. In our coverage universe, we believe Shopify has put the greatest relative R&D effort forward into leveraging AI, with the greatest potential for positive impact from AI on its business and customer base. As a founding partner of the Vector Institute in Toronto, Shopify is funding research around new techniques to apply recommender systems to personalize the Shopify experience for merchants and their customers.

Shopify: Artificial Intelligence is everywhere…

Shopify’s platform currently has 500K+ merchant stores. These stores generate a significant amount of omni-channel retail operational data flows and consumer sales transaction data that can help Shopify with the design and development of new and improved services and e-commerce outcomes. Shopify has long used its massive data collection platform to run analytics to better understand its customer’s needs. Shopify is currently using recommendation algorithms in its app and theme stores to help merchants find the best apps and themes for their businesses. In addition, machine learning is being used for order fraud detection to help merchants reduce costs.

In early 2016, Shopify acquired Kit CRM, an intelligent virtual marketing assistant technology. Kit helps merchants on the Shopify platform manage and automate marketing tasks, including running targeted ads, posting updates on social media, making recommendations based on store activities, and more. Through an API, Shopify app developers can access and utilize the functionality of Kit. We expect Shopify to continue to enhance the functionality of Kit as well as seek additional AI acquisition opportunities. Shopify Capital is also utilizing AI technology to automatically find, select, and offer credit services to merchants. We expect this automated approach to help Shopify rapidly expand this new service and further improve the “stickiness” of its platform. In the future, we expect Shopify to add more back office and front office AI-enhanced functionality to its platform, including further marketing and customer care automation features. We believe that Shopify’s capital resources, platform approach, and large-scale data flows enable it to rapidly deploy and leverage many types of advanced AI technologies, including predictive and prescriptive analytics, natural language processing, recommendation engines, and deep learning tools. As more AI capability is added to its platform aimed at helping merchants be more successful, we see a number of potential positive impacts to Shopify, including incremental new services and revenue streams, reduced merchant churn levels, and additional competitive differentiation in the e-commerce platform market.

Kinaxis (KXS-T, C$69.56, Hold, Target C$73.00)

We believe that Kinaxis’ RapidResponse supply chain planning platform is well suited to the incorporation of a variety of AI technologies, which we expect the Company to implement over the next few years. The current platform has been built with a significant amount of supply chain planning and management knowledge (or heuristics) that has helped to position the platform as a best-in-class planning solution for manufacturers. While RapidResponse is very capable, with strong predictive features, the product still requires a significant amount of human operator interaction. We believe that Kinaxis is still at a relatively early stage in the development and incorporation of AI technologies into its products, but the Company is investing and moving forward on a number of AI-related projects (utilizing R and Python languages) to push and pull operational data from RapidResponse and utilize external data.

The Company has identified many areas that could benefit from AI, and has narrowed its current development efforts down to some key areas such as detecting and correcting master data, and forecast sensing. Kinaxis is working on applying AI technology to automatically detect trends in operational data, using this to self-heal the supply chain to avoid issues resulting from the use of incorrect information such as lead time, yield, etc. Kinaxis is also investing in AI to help improve upon its current supply chain management predictive capabilities. Additionally, the Company sees an opportunity to apply AI in order to provide users with suggestions as to the best courses of action in adjusting supply chain plans, and, under certain conditions, automatically make the decision. Another area of interest is Demand Sensing, which is utilizing external factors (such as weather data and forecasts) and historical data to help predict demand changes earlier so that operators can adjust their plans.

We expect Kinaxis to steadily enhance the RapidResponse platform with predictive analytics and machine-learning functionality over the next few years to help improve planning responsiveness and operator productivity. We note that pricing models for AI capabilities will need to be worked out as traditional per-seat pricing does not always apply and tiered usage-based pricing is often more appropriate. We understand that several of Kinaxis’s large customers are asking for AI solutions in certain functional areas of their supply chains, with significant expected value propositions from the incorporation of the technology. Given the complexity and mission critical nature of RapidResponse and uniqueness of each customer’s supply chain operation, we expect the rollout of AI functionality and potential revenue impact for Kinaxis would take some time.

Absolute Software (ABT-T, C$7.97, Buy, Target C$11.00)

We believe that Absolute Software is well positioned to potentially benefit from the incorporation of AI technology into its product stack over the next couple of years. The Company has an active AI program in place, largely based on its Palisade Data Loss Prevention team and an increased R&D budget allocation this year. Like many enterprise software vendors, we expect Absolute would also be considering selective tuck-in acquisitions to add to its data analytics and AI expertise. We view Absolute as still in the relatively early development stage with its AI efforts. Absolute’s platform currently monitors millions of devices and captures usage data flows from these devices, which could be harnessed by many customers for

machine-learning applications. Absolute recently ramped up development efforts in data visualization, predictive analytics, and machine learning.

In terms of timing, we expect Absolute to begin to detail its new AI-enhanced product functionality within a few quarters and start to release products sometime next year. While we do not expect AI technology to have a material positive impact on Absolute’s average deal sizes, we do believe that, over time, the Company should be able to expand the value proposition of its current product offering. We believe that the addition of AI-driven features can help make Absolute’s overall platform stickier for existing customers and incrementally more attractive to new enterprise customers, particularly those with large mobile device populations that generate large data flows.

Symbility Solutions (SY-T, C$0.43, Buy, Target C$0.70)

In our opinion, Symbility Solutions has been very proactive this year and is now in the early stages of incorporating machine learning technology into its product offering. Given that its SaaS insurance claims processing platform holds data from millions of property damage claims generated by over 75 insurance companies (and their repair service partners as well), we expect that Symbility should be able to quickly develop value-added product line extensions by applying machine-learning tools to this large data repository.

In late 2016, management began to develop its plan to invest in Artificial Intelligence initiatives and has been actively looking at ways to incorporate this technology throughout its product offerings in all three of its business segments. Symbility has engaged two international leaders in deep learning technology to help the Company develop and implement its AI strategy. Symbility is looking to use AI for image recognition, fraud detection, and claims process automation resulting in a more efficient and improved customer experience. The Company has also recently noted that it is in discussions with its largest insurance customers where there is mutual interest in helping with the funding of these AI initiatives.

Symbility is currently in its first phase of development in its AI strategy, currently working on the Sensai product. Sensai is a new AI-enabled white label app designed to handle smaller size claims in an effort to reduce costs. The app is pre-configured with data of common claims, and uses a chat bot to walk the consumer through the property damage claims process.

Symbility’s Property division is planning to have a more clearly defined AI strategy by the end of 2017, and recently detailed its partnership with DeepLearni.ng to develop both front-end and back-end AI solutions for the claims process. Technology is being used to help with fraud detection, accuracy, automation, and personalization, which should help its claims processing product continuously learn and refine the accuracy of the damage estimates it provides and improve customer experiences. In our view, the Company is well positioned to leverage AI technology as it has access to significant amounts of data via claims (over 5M claims and continuously growing) and workflows that it processes on behalf of insurance customers.

In addition, CoreLogic (CLGX-N, Not Rated), a major Symbility shareholder and go-to-market partner, owns the MSB real estate data repository, which

we believe could also become part of a Symbility AI-enabled solution. Overall, we believe Symbility is very well positioned to develop and launch AI-enabled solutions over the next year or two, which should serve to improve Symbility’s competitive positioning, grow its TAM, and increase the attractiveness of its SaaS platform.

ProntoForms (PFM-T, C$0.40, Speculative Buy, Target C$0.75)

ProntoForms, a SaaS provider of mobile enterprise workflow form solutions, currently provides customers with reporting functionality that includes a BI analytics engine and offers some first-generation predictive capabilities. However, ProntoForms has been assessing advancements in AI over the past year and has recently developed a strategy, with several components, to leverage these new technologies onto its product platform.

ProntoForms currently has several internal development teams working on AI-related projects. The Company is actively engaged with several existing customers in the areas of predictive analytics (e.g., equipment maintenance), voice recognition (potentially adding voice controlled data entry/retrieval for electronic forms), and computer vision technology (e.g., utilizing mobile device cameras to input form data or assess and guide field repairs). ProntoForms is looking to utilize customer data, which its forms applications collect in large volumes on its SaaS platform, along with new AI tools, to drive the next level of productivity, effectiveness, and accuracy of field workers.

To date, few customers have been actively pushing ProntoForms to develop AI-driven applications. However, ProntoForms has already identified several high impact areas that it believes will be able to significantly enhance the value proposition, competitive differentiation, and ROI of its products over time. We expect the Company to begin to announce new AI-enabled products and early trial customers over the next year.

File under: Shopify artificial intelligence, Shopify artificial intelligence leader, Shopify artificial intelligence Canada, Shopify artificial intelligence Ottawa, Shopify artificial intelligence head start, Shopify artificial intelligence in business,

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment