Few sectors are as confusing as financial technology. Between Apple Pay, Stripe, Square, PayPal, Bitcoin and a thousand companies you have never heard of promising to “disrupt” the way we use money to procure goods, it’s not surprising that many investors choose to simply pass on the space.

Few sectors are as confusing as financial technology. Between Apple Pay, Stripe, Square, PayPal, Bitcoin and a thousand companies you have never heard of promising to “disrupt” the way we use money to procure goods, it’s not surprising that many investors choose to simply pass on the space.

But publicly traded merchant bank Difference Capital thinks walking away from “FinTech” would be a mistake.

“We remain very bullish on the sector and believe it is one of the areas where Canada has the potential to become a global leader,” says the company.

In a report prepared by Difference VP Jordan Udaskin and Managing Partner Tom Liston called “Making “Cents” of FinTech”, Difference looked to shine a light on the financial technology space, where they report they have more than 10% of their money invested.

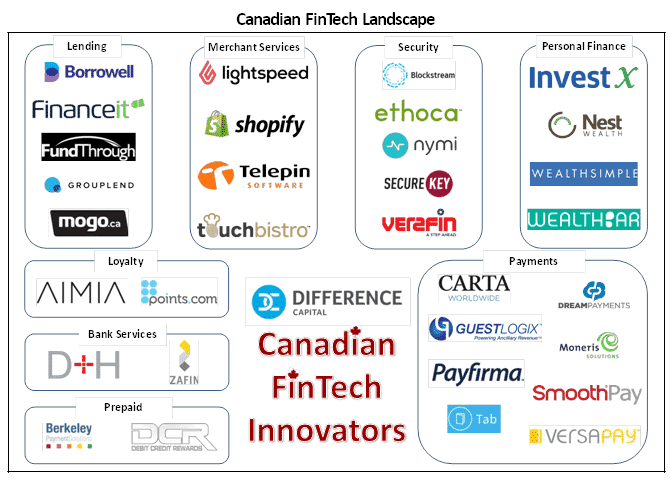

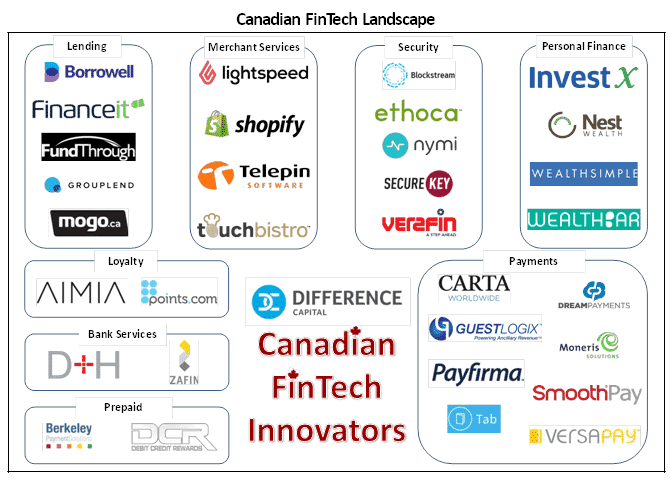

Difference divides the FinTech landscape into several spaces, including lending, merchant services, security, personal finance, loyalty, and payments.

The authors say the unbundling and improving of services has already played out in advertising with Google, in the broadcast sector with Netflix, and in retail with services like Airbnb and Uber. Today, they say, the same thing is beginning to happen with financial technology.

It wasn’t too long ago that innovation in the financial sector was said to involve only innovative fees and tweaks to banking hours. These days nimble organizations, both large and small, have begun to disrupt the Canadian financial landscape.

Difference thinks the lending space is likely to be white hot this year and next following the successful IPOs of US-based OnDeck [NYSE:ONDK] and Lending Club [NYSE:LC]. Udaskin and Liston believe innovators will take advantage of a shifting environment following the credit crisis of 2008 and will employ online, data-driven customer acquisition strategies with real-time analytics to gain an edge on physical store-based payday lenders and traditional bank loan departments. Difference has invested in Mogo, which offers almost instant online personal loans of between $200 and $25,000.

The loyalty space, offers the report, already features two Canadian leaders in Aimia (TSX:AIM), which operates Aeroplan, and Points International (NASDAQ:PCOM, TSX:PTS). The authors think there is more room for disruption.

“Who will lead the loyalty push into new mobile markets remains to be seen,” they offer.

Merchant Services, says Difference, has been a somewhat localized space, but up and comers are already changing the way businesses interact with their customers. One need look no further than Ottawa, where Shopify has recently declared its intentions to go public. Difference has invested in TouchBistro, an iPad restaurant POS platform that just announced a investment from the U.K.-based JustEat [LSE:JE].

The Payments space is making headlines worldwide these days with Apple’s Near Field Communications-based Apple Pay rolling out in the United States. But Difference Capital believes there is a wide range of technology beyond NFC that will soon be employed, including card issuance and processing technologies such as tokenization.

Difference is cautious about the Personal Finance space, which has garnered press in Canada from the emergence of low cost “robo-advisers” such as Wealthsimple and Nest Wealth.

“It could several years for these companies to develop sustainable market positions and achieve profitability given the size of the Canadian market, a highly competitive market and significant regulatory requirements,” says the report.

Difference says the Security and Fraud Prevention space will need to grow in lockstep with other sub sectors to support their advances. They see their portfolio company Ethoca Solutions, which offers merchant-issuer fraud data sharing solutions, and heartbeat authentication play Nymi as up and comers in the space.

The report says the rate of change in the financial space is set to accelerate.

“It wasn’t too long ago that innovation in the financial sector was said to involve only innovative fees and tweaks to banking hours,” says the report. “These days nimble organizations, both large and small, have begun to disrupt the Canadian financial landscape.”

Comment

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Bitcoin Mutual Fund 700% of deposited ASAP

We offer great returns on your profits with 7 investment plans. We have a reserved insurance funds that will guarantee your initial deposit.d

With our program we offer you a continuous daily and compounding profits that will transferred automatically to your account.

http://www.bitcoinmutualfund.net