I am a proud Manitoban, and not only do I cheer for the Jets, I cheer for all things Manitoba.

I am a proud Manitoban, and not only do I cheer for the Jets, I cheer for all things Manitoba.

I cut my life science teeth so-to-speak, as a drug rep covering Manitoba, Saskatchewan and Northwest Ontario – God’s Country. While completing an MBA at the Asper School of Business, I was recruited away from the very attractive drug rep lifestyle to manage investor relations (IR) for an upstart drug development company – Medicure.

At that time, Medicure was TSX and Amex listed, and over the next three years, through all kinds of market oscillations, as a team, we managed to raise $125 million to fund the clinical development for the company’s lead asset through to a Phase III failure. In 2008, I left the company to start my own IR consulting business thinking that Medicure would likely fade away like so many life science companies of that era (BioMS, Vasogen, Allon, etc.), however, the company not only survived, it may yet prosper.

For the majority of its early existence Medicure was focused on the development of MC-1, a drug for the treatment of ischemic reperfusion injury after coronary artery bypass graft surgery. The company completed two successful Phase II studies with MC-1, before embarking on an ambitious 3,000 patient mortality / morbidity Phase III study.

Never one to plan for failure, Bert Friesen, the company’s CEO, began planning for MC-1’s clinical success and a future commercial launch into the U.S. acute cardiovascular disease market. So while the Phase III MC-1 study was enrolling, the company acquired the U.S. rights to a FDA approved acute cardiovascular drug – AGGRASTAT. The plan was to build a U.S.-based acute cardiovascular sales organization around AGGRASTAT at first, and then transition them to MC-1 after its clinical success and subsequent FDA approval; however, things didn’t go as planned. The Phase III study was not successful, and AGGRASTAT, initially viewed as commercial stepping-stone, become the company’s life preserver.

How much can AGGRASTAT grow? Sales for the GP IIb/IIIa inhibitor class have been steadily declining over the past decade. Integrillin, the leading GP IIb/IIIa inhibitor, will likely be generic mid-2015, putting price pressure on the class. So AGGRASTAT is not without its ongoing challenges. However, with only about 4% market share and increasing hospital adoption, near-term growth for AGGRASTAT seems like a safe bet.

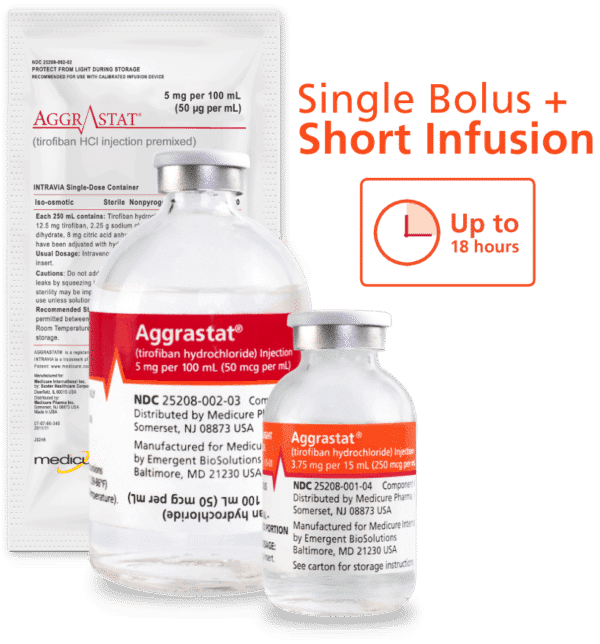

AGGRASTAT belongs to a class of drugs known as glycoprotein IIb/IIIa inhibitors (GP IIb/IIIa inhibitors). These drugs are commonly used in hospitals to prevent clotting in patients presenting with acute cardiovascular symptoms, generally myocardial infarctions (heart attacks) or unstable angina. Originally developed by pharma giant Merck, AGGRASTAT, by the time it was acquired by Medicure, was losing U.S. market share to the other two drugs in the class, ReoPro and Integrillin. Ironically, outside the U.S., AGGRASTAT was more commonly prescribed than its competitors, but at dose not approved by FDA. Outside the U.S., a dosing regimen, known as high dose bolus (HDB), was the most common way to use AGGRASTAT. FDA, however, had only approved AGGRASTAT for a more conservative dosing regimen in the U.S., limiting its utility relative to the other drugs in the class.

So Medicure, still reeling from its clinical failure, found itself trying to survive with an asset, AGGRASTAT, which based on its label had marginal appeal. Yet, the company also knew, based on sales outside the U.S., the drug’s appeal could change dramatically if FDA would approve a HDB label. Accordingly, the company focused its efforts on amassing the data necessary to support a FDA submission for a HDB label. Fortunately, the company didn’t have to run expensive clinical studies to prove the efficacy of AGGRASTAT HDB, the majority of the data already existed, although, not surprisingly, predominantly from studies outside the U.S. The task facing Medicure was convincing FDA to accept this ex-US data to support a broadening of the AGGRASTAT label, known as a supplemental new drug application (sNDA). The new label was desperately needed to rejuvenate a drug that by 2012 had eroded to well below $1 million quarterly sales.

In October 2013, Medicure was successful in attaining FDA approval for HDB AGGRASTAT. The improved label has had the desired effect, with AGGRASTAT sales bouncing off their bottom, and now growing quarter over quarter. Sales of AGGRASTAT in the fourth quarter of 2014 reach almost $2.5 million, and full year 2014 sales were approximately $8.4 million. This is a dramatic improvement over 2013 revenue of $3.2 million, reflecting the positive impact of the HDB label. The company is hinting to investors that growth should continue in 2015, stating in a recent press release, “As the Company enters the 2015 calendar and fiscal year, hospital demand for AGGRASTAT continues to increase significantly.”

How much can AGGRASTAT grow? Sales for the GP IIb/IIIa inhibitor class have been steadily declining over the past decade. Integrillin, the leading GP IIb/IIIa inhibitor, will likely be generic mid-2015, putting price pressure on the class. So AGGRASTAT is not without its ongoing challenges. However, with only about 4% market share and increasing hospital adoption, near-term growth for AGGRASTAT seems like a safe bet.

The company has other projects on the go besides its AGGRASTAT commercial operations; including a small interest in an active pharmaceutical ingredient (API) manufacturer, and development plans for a transdermal formulation of AGGRASTAT. However, in the near-term, investors should be squarely focused on AGGRASTAT sales. As mentioned above the company has guided towards significant sales growth for 2015, but also being EBITDA and earnings positive.

Assuming the company can achieve these goals, it should draw greater investor attention, especially considering Canadians’ proven affinity for publicly traded specialty pharma companies.

I learned a lot during my time with Medicure. Although I would never alter my decision to leave and create my own business, it appears I was wrong in my assumption that the company would eventually fade away. Against difficult odds, they have persevered, a Manitoba comeback story. Kind of like the Jets.

Disclosure: Hogan Mullally owns shares of Medicure.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment