Computer Modelling Group (Computer Modelling Group Stock Quote, Chart, News: TSX:CMG) has withstood low oil prices before and can do it again, says Industrial Alliance analyst Steve Li.

Computer Modelling Group (Computer Modelling Group Stock Quote, Chart, News: TSX:CMG) has withstood low oil prices before and can do it again, says Industrial Alliance analyst Steve Li.

Computer Modelling Group will report its third quarter, 2015 results on Wednesday before market open. Li expects that the company will post adjusted net income of $8.3-million on revenue of $19.9-million, slightly higher than the street consensus of a $19.7-million topline.

Li notes that the Canadian dollar dropped 7.6% during CMG’s Q3 and that its deferred revenues grew 18.5% year-over-year to $22.9-million. Li says deferred revenue has been a historic leading indicator for the company, normally by one or two quarters.

The analyst addressed the issue of low oil prices on Computer Modelling Group’s business.

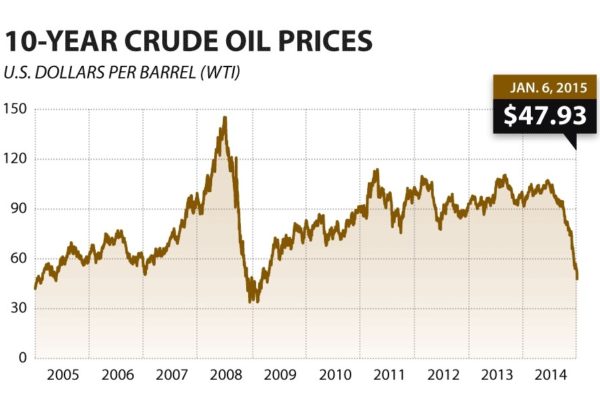

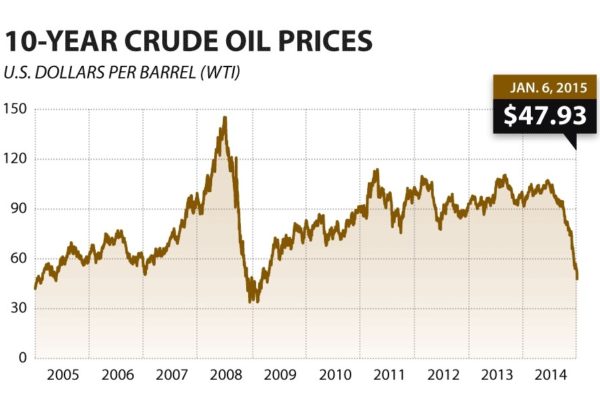

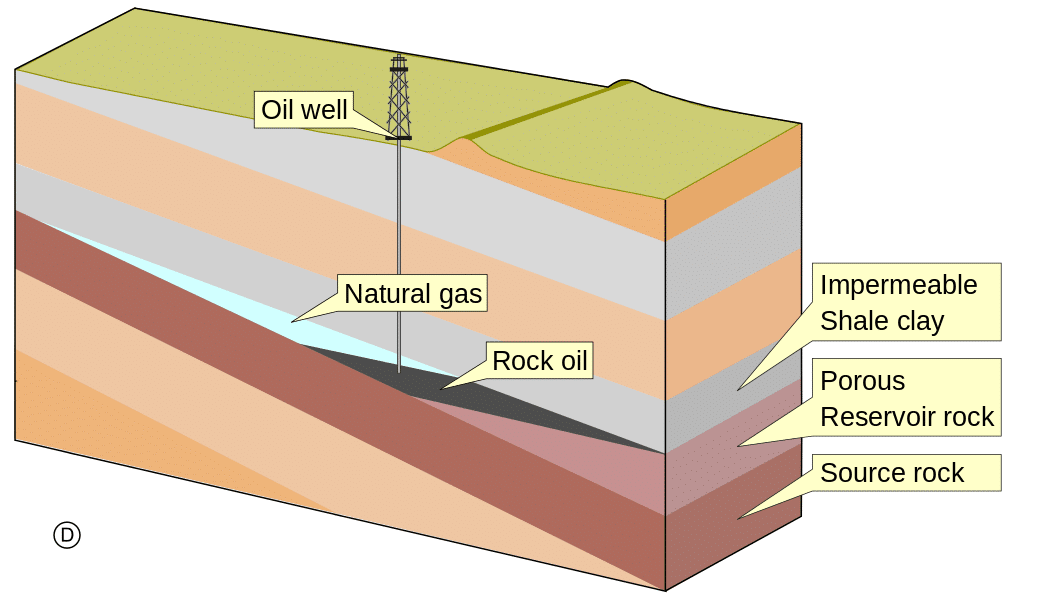

“…we would like to remind investors that CMG grew its annuity license in 2008-2009 despite oil prices falling to US$32,” he said. “While some may question the economic viability of unconventional reservoir development at the current price, it is important to highlight that 70% of worldwide reserves are from unconventional sources and that this accounts for less than 10% of worldwide production. Moreover, the increasing adoption of Enhanced Oil Recovery techniques will benefit CMG given its strong expertise.”

In a research update to clients Friday, Li reiterated his “Buy” rating and $14.00 one-year target price on Computer Modelling Group, implying a return of 15.8% at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment