Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart TSX:ONC) announced its third quarter financials on Monday, with the Calgary-based cancer biologics developer producing numbers that came in-line with expectations, according to Douglas Loe of Echelon Wealth Partners. Yet potential delays in the start to a pivotal clinical trial have prompted the analyst to drop his one-year price target from $20.75 to $11.00 while maintaining his “Speculative Buy” recommendation.

Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart TSX:ONC) announced its third quarter financials on Monday, with the Calgary-based cancer biologics developer producing numbers that came in-line with expectations, according to Douglas Loe of Echelon Wealth Partners. Yet potential delays in the start to a pivotal clinical trial have prompted the analyst to drop his one-year price target from $20.75 to $11.00 while maintaining his “Speculative Buy” recommendation.

ONC’s third quarter 2018 resulted in an EBITDA loss of $3.1 million comparable to an operating cash loss of $2.9 million. The company exited the quarter with $16.2 million in cash and cash equivalents, although it also has access to US$56 million in equity capital made available through share purchase agreements put in place in September and October of this year.

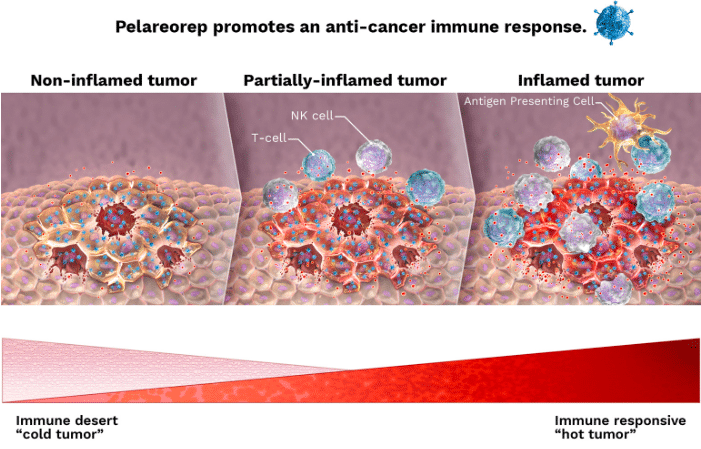

The company is developing pelareorep (Reolysin), an intravenously delivered immuno-oncolytic virus, with President and CEO Dr. Matt Coffey saying that the his company’s progress concerning pelareorep during 2018 are laying the groundwork for a “transformational” 2019.

“We continue to advance towards a registration study in metastatic breast cancer as we prepare to initiate our AWARE-1 window of opportunity clinical study with pelareorep and Roche’s checkpoint inhibitor, Tecentriq, in breast cancer patients,” said Coffey in a press release.

Loe says that financial metrics at this stage have minimal impact on his investment thesis compared to clinical milestones achieved with Reolysin. On that front, the analyst notes data from a Phase II metastatic breast cancer study which he describes as “highly positive on overall survival” but which nevertheless did not meet its actual primary endpoint on progression-free survival and, moreover, has yet to create the sought-after outside partnership interest.

“Take-out valuations for Oncolytics’ peers (most recently, private Austria-based ViraTherapeutics by Boehringer Ingelheim in Sep/18 and publicly-traded Australia-based Viralytics by Merck in Feb/18, to name two and without reflecting further back to the US$1B valuation initially ascribed to BioVex by Amgen back in 2011) provide supporting evidence that global pharmaceutical giants see value in oncolytic virus development as a concept,” Loe writes in a client update on Monday. “Clearly, capital markets are placing long odds on ONC’s potential to be similarly regarded by potential suitors down the road.”

“Our revised PT implies that we are willing to accept those odds and by inference, to accept as plausible that Reolysin can perform well and to future acquirer’s satisfaction in all ongoing and contemplated cancer studies, specifically in breast and pancreatic cancer as described,” he says.

Loe says ONC could trade sideways until new clinical data are available next year. His $11.00 target represents a projected return of 228 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment