Despite a quarter that fell below his expectations, Canaccord Genuity analyst Matt Bottomley still thinks OrganiGram (TSXV:OGI) is undervalued.

Despite a quarter that fell below his expectations, Canaccord Genuity analyst Matt Bottomley still thinks OrganiGram (TSXV:OGI) is undervalued.

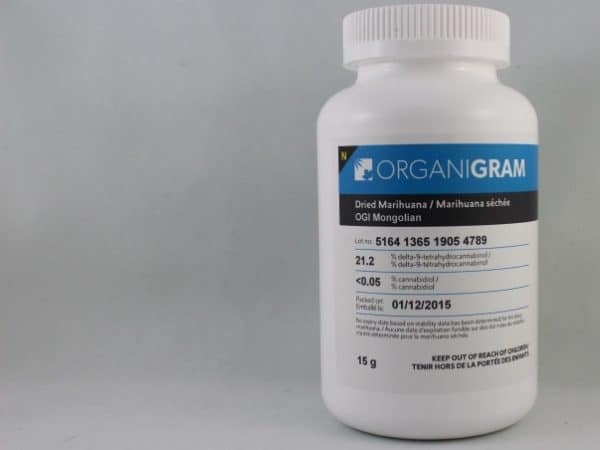

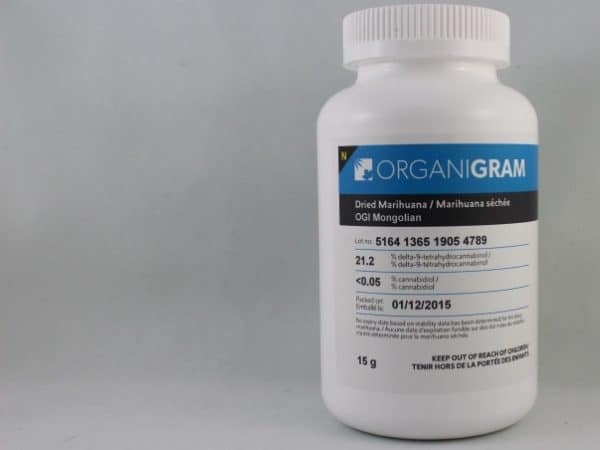

Last Friday, OrganiGram reported its Q2, 2017 results. The company lost $5.75-million on sales of negative $581,169, a topline backpedal that was the result of a $2-million product recall.

“While the product recall was obviously an unfortunate event for the company and the patients who rely on Organigram for access to their medicine, I am pleased with the way our team has dealt with this challenge,” said CEO Greg Engel. “It forced us to re-examine our quality assurance practices and implement new procedures that will help us achieve our goal of producing Canada’s safest cannabis. I anticipate a return to growth in coming quarters and believe the outlook for our company has never been brighter.”

Bottomley says OrganiGram’s Q2 results did fall short of his expectations. He thought the company would post net revenue of negative $100,000 and EBITDA of negative $2.2-million, instead of the negative $4.7-million EBITDA number the company posted. But the analyst says he is looking past what was never going to be a good quarter and on to OrganiGram’s longer term future, which he sees as bright.

“Although Q2 results were a little light versus our estimates, it was nonetheless expected to be a messy quarter due to the significance of the product recall and the overall disruption to the company’s operations,” he says. “Looking ahead, OrganiGram has since put additional quality assurance procedures in place in an effort to right the ship and provided an encouraging operational update in early Q3, indicating it achieved its highest weekly sales to date.”

In a research update to clients today, Bottomley maintained his “Speculative Buy” rating and one-year price target of $3.40 on OrganiGram, implying a return of 31.3 per cent at the time of publication.

Bottomley thinks OrganiGram will post EBITDA of negative $1.9-million on revenue of $9.0-million in fiscal 2017. He expects these numbers will improve to EBITDA of $12.2-million on a topline of $36.0-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment