Cannabis Market and Movers Last Week

Cannabis Market and Movers Last Week

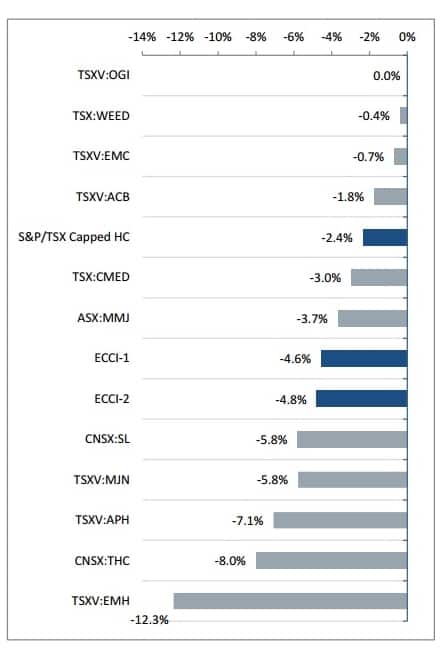

The peer group performed poorly last week, reinforcing our view that some investors took a ‘buy on the rumour, sell on the news’ approach to the tabling of cannabis legislation. Weaker performers included those that have recently announced equity financings. OGI was the top performer, with a break-even week proving enough to the lead the pack. WEED (Speculative Buy, $14.00 TP) and EMC (Speculative Buy, $5.25 TP) both outperformed by holding ground relatively well.

Canopy Growth Corporation (WEED-TSX, Speculative BUY, $14.00 TP) Announces Plans to Carry 3rd Party Products through CraftGrow Line – In addition to three initial 3rd party producers, the press release encouraged other cannabis LPs to reach out to the Company. The cannabis industry continues to see excess demand, and we therefore view this as a prudent means of broadening the Company’s product line and adding depth to supply. Importantly, all CraftGrow cannabis will be subject to WEED’s quality assurance program, which includes testing by an accredited lab, prior to being sold. The Company also announced the launch of a new proprietary cannabis oil blend called FORIA, which sells for $85/bottle. Uniquely, the terpenes have been removed from the oil so that it is almost odorless.

The Tinley Beverage Company (TNY-CSE) Launches Cannabis-Infused Beverages in California – Tinley ’27 is a line of cannabis extract-infused, alcohol-free beverages made with essences and flavours used in popular alcohol spirits and liqueurs. Management noted that emerging data suggests some consumers are switching from alcohol to cannabis. The Company will be making this product available to dispensaries in California.

Aphria (APH-TSX, NR) Raises $100M in Equity & Debt – APH announced it had secured $100M in new financing, including a $75M bought deal equity financing at $6.50/shr (or $86.3M assuming overallotment exercised in full) and a $25M five-year term loan (15-year amortization) at 3.95% from WFCU Credit Union. Approximately ½ of the proceeds of the combined offering are earmarked for the Part IV Expansion, with the other ½ intended for related working capital as well as strategic investments. The Part IV Expansion is expected to take aggregate annual capacity to 75,000 kg, with completion expected in 2018. The bought deal is expected to close on May 9th, which is the same date management expects to enter the credit facility. WFCU Credit Union was founded in 1941, and is now the 6th largest credit union in Ontario with $2.9B in managed assets. While many cannabis companies have been active on the equity financing front, this is by far one of the largest credit packages we have seen thus far in the space.

CanniMed Therapeutics (CMED-TSX, NR) to Increase Oil Facility Expansion – CMED announced plans for a GMPcompliant ethanol extraction facility with an initial annual capacity of 12M 60ml bottles of oil. The CAPEX is estimated at $10.5M over 20 months. Oils already contribute approximately 46% of the Company’s revenue (based on March sales), making CMED’s sales base one of the most oils-driven amongst Canadian producers. CMED uses ethanol (foodgrade alcohol) extraction to purify cannabinoids, while many other producers use CO2 extraction methods. CanniMed currently dominates the cannabis oil market in Canada, with an approximate 70%+ market share (as reported in the December 2016 prospectus), having just introduced the product line in February 2016.

Aurora Cannabis (ACB-TSXV, NR) Begins Sales of Cannabis Oils – ACB announced the launch of three Aurora Drops oil products, all priced at $115/30 ml bottle (or $80/bottle for clients approved for the Company’s compassionate pricing program). Two are high-potency THC products (one extracted from sativa, one from indica) and the 3rd is a high potency CBD product.

Emerald Health Therapeutics (EMH-TSXV, NR) Launches Oils, and Closes Bought Deal Prospectus Offering + Part of Shoe – EMH announced closing of the base $24.4M as well as $2.8M of the overallotment. The offering was at $1.85/unit, with each unit including a share plus ½ warrant convertible at $2.60/shr for two years. EMH has the option of accelerating the expiry data if the closing price exceeds $3.50/shr for 20 consecutive trading days. The proceeds are to be used to accelerate expansion plans, R&D and working capital/general corporate purposes. Earlier in the week, EMH announced that it had launched two oil products, which it believes are the highest-CBD/low-THC oil products legally available in the market.

Where Do Conservative Party Leadership Hopefuls Stand?

Media reports indicated that Mr. Kevin O’Leary appears to support legalization, predicting that cannabis is “going to be part of the Canadian culture” according to the Globe= and Mail. As we noted in last week’s edition, Dr. Kellie Leitch (a pediatric surgeon) describes cannabis as a dangerous drug, noting that she would roll back its legalization if she were to become Prime Minister. Ms. Lisa Raitt said that she would vote against legalization, but would not attempt to roll it back if/when the bill becomes law. Finally, Mr. Maxime Bernier has declined to say whether he will vote in favour of the legislation, although he has been endorsed by cannabis activist, Mr. Marc Emery (also known as the Prince of Pot).

Advocate for Pharma Distributors Argues they are a Proven Solution –The Canadian Association for Pharmacy Distribution Management (CAPDM) CEO Mr. David Johnston is pitching pharmaceutical distributors as a natural partner for the distribution of cannabis, for both the medical and recreational markets. Pharmaceutical distributors deliver 95% of all retail pharmaceuticals in Canada. CAPDM’s board of directors includes executives from uniPHARM Drugs, Kohl & Frisch, McKesson, Hoffmann-La Roche, McMahon Distributeur pharmaceutique, Sandoz and Shoppers Drug Mart.

Alberta’s Minister of Justice: Better to Start with Tighter Regulation – Alberta’s MOJ Ms. Kathleen Ganley has said that the province will consult with residents as to the appropriate legal age for recreational sales, and that co-location of alcohol and cannabis is unlikely. She also noted that one of the main lessons Alberta learned from Colorado was that it would be easier to start with more regulation in the early days of legalization, rather than less.

Quebec’s Liquor Store Union Wants to Carry Cannabis –Mr. Alexandre Joly, head of the union representing SAQ employees (The Societe des alcools du Quebec) is arguing for provincial government control of distribution. The union released a union-funded study in December predicting that SAQ-controlled cannabis distribution would add $457M in provincial revenue in year one of legalization. The study predicted that the province’s cannabis market could reach $3.2B in annual sales within 10 years. Montreal’s public health department is arguing against SAQ distribution control, opining that SAQ’s revenue-focused model with alcohol is not a fit for cannabis.

GW Pharmaceuticals (GWPH-NASDAQ, NR) Announces Positive Results from 2nd Phase 3 Study of Epidiolex® – The results indicated that adding Epidiolex® to current patient treatment of LGS significantly reduced the frequency of drop seizures. LGS (Lennox-Gastaut syndrome) is a form of epilepsy known for being very difficult to treat, with drug resistance noted as one of its main features. The data showed a median reduction in monthly drop seizures of 37% for 10 mg/kg/day doses, and 42% for 20 mg/kg/day doses vs. a 17% reduction for placebo. Epidiolex® was well tolerated in the trial, with the pattern of adverse events consistent with that of prior Phase 3 studies. Peak onset of LGS typically occurs in children at 3-5 years of age, and in up to 30% of patients, no cause can be found. Most children with LGS experience intellectual disability and behavioural disturbances.

Namaste Technologies (N-CSE, NR) Signs Definitive Agreement to Acquire Late Stage LP Applicant – Namaste plans to acquire CannMart Inc. for $3.55M (almost all of that in stock, including potential milestone payments). CannMart applied for a “sales only” license in 2014. It has completed the security clearance stage, and is now in the review stage of the process. It intends to purchase cannabis on a wholesale basis from other LPs.

ECHELON WEALTH PARTNERS INC. DISCLOSURES

Important Information and Legal Disclaimers

Echelon Wealth Partners Inc. is a member of IIROC and CIPF. The documents on this website have been prepared for the viewer only as an example of strategy consistent with our recommendations; it is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or instrument or to participate in any particular investing strategy. Any opinions or recommendations expressed herein do not necessarily reflect those of Echelon Wealth PartnersInc. Echelon Wealth Partners Inc. cannot accept any trading instructions via e-mail as the timely receipt of e-mail messages, or their integrity over the Internet, cannot be guaranteed. Dividend yields change as stock prices change, and companies may change or cancel dividend payments in the future. All securities involve varying amounts of risk, and their values will fluctuate, and the fluctuation of foreign currency exchange rates will also impact your investment returns if measured in Canadian Dollars. Past performance does not guarantee future returns, investments may increase or decrease in value and you may lose money. Data from various sources were used in the preparation of these documents; the information is believed but in no way warranted to be reliable, accurate and appropriate. Echelon Wealth PartnersInc. employees may buy and sell shares of the companies that are recommended for their own accounts and for the accounts of other clients.

Echelon Wealth Partners compensates its Research Analysts from a variety of sources. The Research Department is a cost centre and isfunded by the business activities of Echelon Wealth Partners including, Institutional Equity Sales and Trading, Retail Sales and Corporate and Investment Banking.

Research Dissemination Policy: All final research reports are disseminated to existing and potential clients of Echelon Wealth PartnersInc. simultaneously in electronic form. Hard copies will be disseminated to any client that has requested to be on the distribution list of Echelon Wealth PartnersInc. Clients may also receive Echelon Wealth PartnersInc. research via third party vendors. To receive Echelon Wealth PartnersInc. research reports, please contact your Registered Representative. Reproduction of any research report in whole or in part without permission is prohibited.

Canadian Disclosures: To make further inquiry related to this report, Canadian residents should contact their Echelon Wealth Partners professional representative. To effect any transaction, Canadian residents should contact their Echelon Wealth Partners Investment advisor.

U.K. Disclosures: This research report was prepared by Echelon Wealth PartnersInc., a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. ECHELON WEALTH PARTNERSINC. IS NOT SUBJECT TO U.K. RULES WITH REGARD TO THE PREPARATION OF RESEARCH REPORTS AND THE INDEPENDENCE OF ANALYSTS. The contents hereof are intended solely for the use of, and may only be issued or passed onto persons described in part VI of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001. This report does not constitute an offer to sell or the solicitation of an offer to buy any of the securities discussed herein.

U.S. Disclosures: This research report was prepared by Echelon Wealth PartnersInc., a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. This report does not constitute an offer to sell or the solicitation of an offer to buy any of the securities discussed herein. Echelon Wealth Partners Inc. is not registered as a broker-dealer in the United States. The firm that prepared this report may not be subject to U.S. rules regarding the preparation of research reports and the independence of research analysts.

Copyright: This report may not be reproduced in whole or in part, or further distributed or published or referred to in any manner whatsoever, nor may the information, opinions or conclusions contained in it be referred to without in each case the prior express written consent of Echelon Wealth Partners.

RATING DEFINITIONS

Buy The security represents attractive relative value and is expected to appreciate significantly from the current price over the next 12 month time horizon.

Speculative Buy The security is considered a BUY but in the analyst’s opinion possesses certain operational and/or financial risks that are higher than average.

Hold The security represents fair value and no material appreciation is expected over the next 12-18 month time horizon.

Sell The security represents poor value and is expected to depreciate over the next 12 month time horizon.

Under Review While not a rating, this designates the existing rating and/or forecasts are subject to specific review usually due to a material event or share price move.

Tender Echelon Wealth Partners recommends that investors tender to an existing public offer for the securities in the absence of a superior competing offer.

Dropped Coverage Applies to former coverage names where a current analyst has dropped coverage. Echelon Wealth Partners will provide notice to investors whenever coverage of an issuer is dropped.

RATINGS DISTRIBUTION

Recommendation Hierarchy Buy Speculative Buy Hold Sell Under Review Restricted Tender

Number of recommendations 43 34 11 0 3 1 2

% of Total (excluding Restricted) 47% 37% 12% 0% 3%

Number of investment banking relationships 8 11 1 0 1 1 0

% of Total (excluding Restricted) 38% 52% 5% 0% 5%

uRRARE EARTHS Comp TableRARE EARTHS Comp Table

8

Cannabis Weekly

Weekly Comps | April 24, 2017 Russell Stanley, CFA, MBA – Special Situations Analyst | 647.794.1922 | rstanley@echelonpartners.com

ECHELON WEALTH PARTNERS INC. DISCLOSURES

ANALYST CERTIFICATION(S)

Company: Emblem Corp. | EMC: TSXV

I, Russell Stanley, hereby certify that the views expressed in this report accurately reflect my personal views about the subject securities or issuers. I also certify that I have not, am not, and will not receive, directly or indirectly, compensation in exchange for expressing the specific recommendations or views in this report.

Company: Canopy Growth Corporation | WEED: TSX

I, Russell Stanley, hereby certify that the views expressed in this report accurately reflect my personal views about the subject securities or issuers. I also certify that I have not, am not, and will not receive, directly or indirectly, compensation in exchange for expressing the specific recommendations or views in this report

IMPORTANT DISCLOSURES

Is this an issuer related or industry related publication? INDUSTRY

1) Does the Analyst or any member of the Analyst’s household have a financial interest in the securities of the subject issuer? If Yes: a) Is it a long or short position? Long b) What type of security is it? Stock

Company Name Ticker Disclosures

2) Does the Analyst or household member serve as a Director or Officer or Advisory Board Member of the issuer? Emblem Corp. EMC-TSXV 5, 7

3) Does Echelon Wealth Partners Inc. or the Analyst have any actual material conflicts of interest with the issuer? Canopy Growth Corporation WEED-TSX 5,6,7

4) Does Echelon Wealth Partners Inc. and/or one or more entities affiliated with Echelon Wealth Partners Inc. beneficially own common shares (or any other class of common equity securities) of this issuer which constitutes more than 1% of the presently issued and outstanding shares of the issuer?

Aurora Cannabis Inc. ACB-TSXV 5,6

5) During the last 12 months, has Echelon Wealth Partners Inc. provided financial advice to and/or, either on its own or as a syndicate member, participated in a public offering, or private placement of securities of this issuer?

Supreme Pharmaceuticals Inc. SL-CNSX 5

6) During the last 12 months, has Echelon Wealth Partners Inc. received compensation for having provided investment banking or related services to this Issuer? Cronos Group MJN-TSXV

7) The analyst had an on-site visit with the Issuer within the last 12 months. OrganiGram Holdings Inc. OGI-TSXV 5

8) Has the Analyst been compensated for travel expenses incurred as a result of an on- site visit with the Issuer within the last 12 months? CanniMed Therapeutics Inc. CMED-TSX

9) Has the Analyst received any compensation from the subject company in the past 12 months? Emerald Health Therapeutics Inc. EMH-TSXV 5

10) Is Echelon Wealth Partners Inc. a market maker in the issuer’s securities at the date of this report? THC BioMed THC-CNSX

Canabo Medical Inc. CMM-TSXV 5

Aphria Inc. APH-TSX The Hydropothecary Corporation THCX-TSXV

http://research.echelonpartners.com/research/disclosures.php

uRRARE EA

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment