The eyes of speculative investors were not set on technology stocks in 2016, because marijuana stocks stole their gaze. Still, a list of the top performing Canadian junior tech stocks stacks up quite well. The reason? A once paltry selection of stocks has rounded out quite nicely in the past few years.

The IPO drought that has stricken the big board hasn’t stopped a bunch of new companies from staking their claim on the junior exchange.

The October appointment of Brady Fletcher, a banker with a B.Sc. in Computer Engineering who is well known in innovation circles, to head the TSX Venture Exchange, suggests this trend may continue.

So here is our annual countdown of the top ten TSXV Tech stocks. The list comes with a few caveats: we don’t include stocks that began the year under ten cents, ones that had a change of business during the year (i.e. RTO), or those that do not have a full year of trading under their belt. All technology stocks trading on the TSX Venture Exchange are eligible.

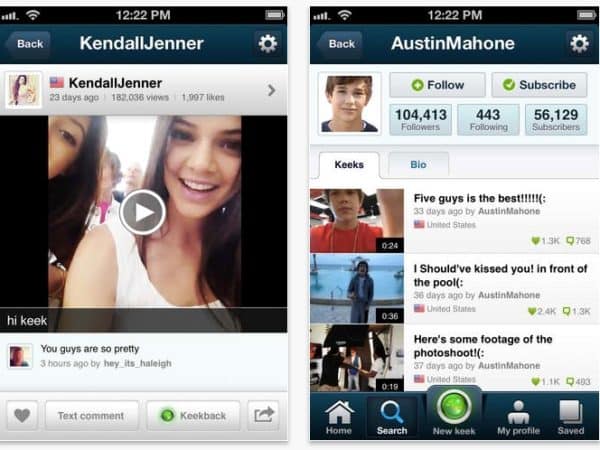

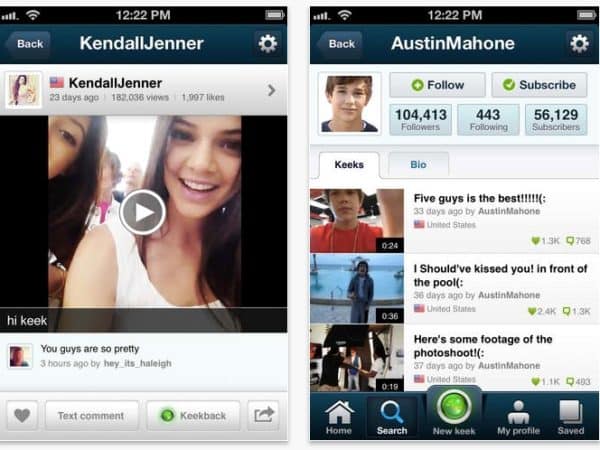

1. Keek (TSXV:KEK)

Price on December 31, 2015: $0.33

Price on December 23, 2016: $1.18

Percentage Change: +258%

Shares of the Vine-like video sharing service Keek spent much of 2016 simply meandering along. Then, in late October, the stock began to soar on the back of the company’s partnership with livestreaming app Peeks, a deal Keek says will allow users to create individual live home shopping channels.

“We believe that the trillion dollar plus global e-commerce industry is ripe for disruption,” says CEO Mark Itwaru. “Currently it relies on a 2D environment where consumers make purchasing decisions based on static images and text. We are planning to enable consumers to shop inside a thriving live commerce environment which allows for real time interaction and seamless purchasing. This environment will empower sellers and buyers alike.”

2. BTL Group (TSXV:BTL)

Price on December 31, 2015: $0.45

Price on December 23, 2016: $1.20

Percentage Change: +167%

BTL Group, with offices in Vancouver and London’s Canary Wharf, where it launched one of the first Bitcoin ATMs to London, was one of the world’s publicly-listed blockchain companies. In November, the company completed EY’s (formerly known as “Ernst & Young”) six-week 2016 Startup Challenge, which challenged companies specializing in blockchain technology to address issues particular to either digital rights management (DRM) or energy trading. BTL developed an advanced Energy Trading Risk Management (ETRM) application called Interbit, to explore ways of transforming how energy trades are created and settled, while also driving down costs and reducing risk in the market.

3. Prodigy Ventures (TSXV:PGV)

Price on December 31, 2015: $0.10

Price on December 23, 2016: $0.25

Percentage Change: +150%

Toronto-based fintech player Prodigy Ventures peaked in May but could not hold onto gains that would have placed it at the top of this list. The company, which in a sometimes confusing mix has an eye towards markets such as augmented reality, saw its modest numbers improve significantly throughout the year. After its Q2 topline came in 112 per cent better than the year before, the company’s CEO, Tom Beckerman, summarized where Prodigy was at.

“We continue to generate strong profitability as we grow our relationships with our enterprise clients,” he said. “At the same time, we have grown our R&D investments in our new ventures in mobile video, proximity, wearables, 3D and augmented reality, and we look forward to new product launches before year end.”

4. AcuityAds (TSXV:AT)

Price on December 31, 2015: $0.94

Price on December 23, 2016: $2.30

Percentage Change: +144.7%

After AcuityAds thord quarter results, reported on November 8, Haywood analyst Pardeep Sangha raised his price target on the stock from $3.00 to $3.50. The analyst noted that Acuity’s third quarter beat both his and consensus estimates on both the top and bottom line. He said that with a successful tuck-in acquisition already complete, the company is now on the hunt for more acquisitions. Overall, Sangha said when compared to its peers, Acuity still looks cheap.

“We believe Acuity is undervalued, currently trading at 1.2x EV/Revenue of our CY17 estimates, which is lower than the average of its US Ad Tech peer group and Canadian Software and Services peer group which trades at 2.3x EV/Revenue based on consensus CY17 estimates,” says the analyst. “We arrive at our target price by applying a 1.8x multiple to our FY17 revenue estimate, or 1.6x multiple to our FY18 estimate.”

5. Breaking Data Corp. (TSXV:BKD)

Price on December 31, 2015: $0.18

Price on December 23, 2016: $0.415

Percentage Change: $130.6%

Shares of Concord, Ontario-based Breaking Data, formerly known as Sprylogics, were another whose shares made a late charge to the pole. On September 19, Breaking Data’s stock began a multi-month run after the company announced a partnership to power LYCOS Sports.

“Our experience with social, unstructured and structured data enables Breaking Data to deliver specialized services,” said CEO Marvin Igelman. “We offer our BreakingSports app technology that personalizes professional sports content to anonymous individuals based on what they find relevant and useful. Breaking Data delivers all media formats in real-time, without overwhelming users. We look forward to providing exactly what’s needed for LYCOS users without them having to work hard to find what they want or enjoy — namely sports on-the-go.”

6. NamSys (TSXV:CTZ)

Price on December 31, 2015: $0.33

Price on December 23, 2016: $0.65

Percentage Change: +97%

Bolton, Ontario-based NamSys, formerly known as Cencotech, makes sure cash gets where it needs to go safely and the company’s numbers are improving. In the third quarter of 2016 the company’s topline climbed 60 per cent to $711,778, up from just $452,487.

“As reported previously, the Company is continuing to make progress in moving new product sales opportunities forward, particularly with respect to our Cirreon (SaaS) and related software offerings,” said CEO Barry Sparks. “We are pleased with the progress being made and particularly with the market’s adoption of our Cirreon offerings. We remain optimistic for increasing sales and profitability growth going forward.”

7. Gatekeeper Systems (TSXV:GSI)

Price on December 31, 2015: $0.14

Price on December 23, 2016: $0.275

Percentage Change: +96.4%

Shares of Burnaby-based Gatekeeper Systems, which provides high-res video for security and mobile apps, rose midway through the year on the back of improving numbers. In April, Gatekeeper reported that its second quarter revenue had increased by 81 per cent to $1,726,008, up sequentially from $955,574. CEO Doug Dyment said the improvements were a preview of things to come. “The second quarter revenue increase and profitability are indicators that we are successfully executing on our business strategy,” he said.

8. OneSoft Solutions (TSXV:OSS)

Price on December 31, 2015: $.10

Price on December 23, 2016: $.195

Percentage Change: +95%

Edmonton-based OneSoft Solutions is a spinoff of Serenic Corporation, a firm that designed accounting software for non-profits and sold its operating subsidiaries in 2014. OneSoft promises to offer disruptive new technology that will enable pipeline operators to better manage an aging infrastructure. In April, Cantech Letter talked to the company’s management team.

9. Opsens (TSXV:OPS)

Price on December 31, 2015: $0.86

Price on December 23, 2016: 1.57

Percentage Change: +82.6%

The oil and gas sensor company that became a medical device sensor company has long thought to be undervalued by many Bay Street analysts. Just over a year ago, Paradigm Capital analyst Christopher Lam said he had increasing optimism about the company heading into 2016. At the time his one-year target price of $2.15 seemed ambitious, as it implied a return of 126 per cent at the time of publication. Not any more.

10. Symbility Solutions (TSXV:SY)

Price on December 31, 2015: $0.28

Price on December 23, 2016: $0.50

Percentage Change: +78.6%

It’s had a good year, but Industrial Alliance Securities analyst Blair Abernethy thinks there is still upside in Symbility Solutions. In late November, following the company’s third quarter results, the analyst raised his one-year price target on the stock from from $0.55 to $0.65.

“We remain positive on Symbility as the company’s innovative solutions continue to gain traction in the marketplace,” said the analyst. “We remind investors that CoreLogic (~28% owner of Symbility) has a takeover Standstill Agreement which expires in April 2017, which we believe helps to create a “floor” for Symbility’s stock. Symbility continues to have a strong pipeline of opportunities and pilots in North America, Asia and Europe and notes that its conversion rate is still ~67%. Conversion of these pilots should help support Symbility’s growth profile in 2017 and beyond.”

Disclosure: OneSoft is an annual sponsor of Cantech Letter and Editor Nick Waddell owns share in the company.

Comment

One thought on “The Ten Best Performing Canadian Junior Tech Stocks of 2016”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Nick, what about Pioneering Technology Corp – PTE.V?