Lower than expected production costs and higher revenue offset the negative that was a larger than expected EBITDA loss for Canopy Growth Corp. (Canopy Growth Corp. Stock Quote, Chart, News: TSX:CGC) in its Q1, 2017 results, says PI analyst Jason Zandberg.

Lower than expected production costs and higher revenue offset the negative that was a larger than expected EBITDA loss for Canopy Growth Corp. (Canopy Growth Corp. Stock Quote, Chart, News: TSX:CGC) in its Q1, 2017 results, says PI analyst Jason Zandberg.

This morning, Canopy Growth reported its Q1, 2017 results. The company lost $3.94-million on revenue of $7.0-million, a topline that was up 308 per cent over the same period last year.

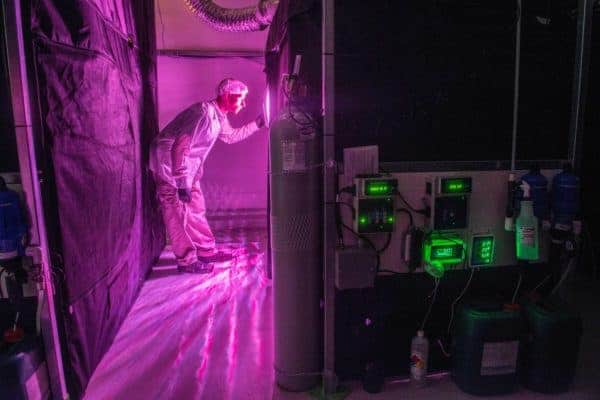

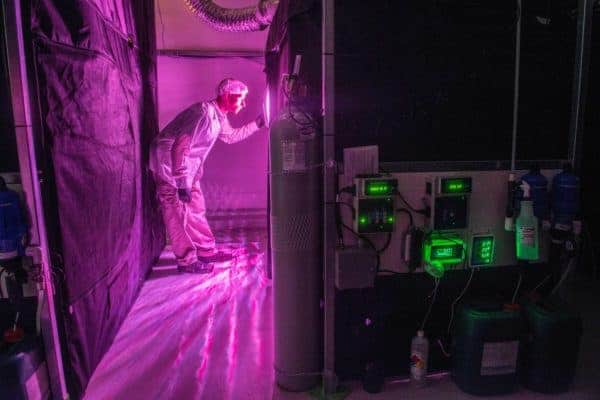

“Our business took many important steps forward, in both Canada and abroad, during the first quarter,” said CEO Bruce Linton. “Continued investment helped our business deliver its eighth consecutive quarter of double-digit percentage growth in revenue, product sold and registered patients. During the quarter we brought the full Tweed Farms greenhouse, all 350,000 square feet, into production. With close to 600,000 square feet in production across the corporation, in both low-cost greenhouse and indoor growing facilities, the capability and flexibility that we have to produce large quantities of high-quality dried cannabis and extracts, to meet potential future market demand, is unmatched in the sector. Investment in international development drove agreements with partners in Australia, Brazil and Germany. With other opportunities presenting themselves, the global expansion of our business has just begun.”

Zandberg says the softer numbers and those that were better than expected more or less balanced out, causing him to maintain his “Buy” rating and one-year price target of $4.25 on Canopy Growth.

“Given the larger EBITDA loss during the quarter, we increased our operating expense outlook in FY17 but kept our expense assumptions for FY18 and FY19,” says the analyst. “We have revised our revenue assumption slightly upward due to the better-than-expected sales in this quarter. Our revised forecasts include revenue of $37.8M in FY17 (previously $34.6M) and $76.0M in FY18 (previously $71.8M). Our EBITDA forecast for this year is a loss of $3.0M (previously $0.8M) and $13.6M in FY18 (previously $13.8M).”

Zandberg expects Canopy will lose $0.10 a share on revenue of $37.81-million in fiscal 2017, numbers he expects will improve to earnings of $0.04 on a topline of $76.0-million the following year.

Comment

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

I’ve already doubled my money on this stock. Big gains coming my way

Q1 2017 historical results?