Eden Rahim, portfolio manager for the Next Edge Bio-Tech Plus Fund, appeared on BNN recently to talk about the challenges inherent in identifying promising biotech and drug development prospects which may be ripe M&A targets for larger pharmaceutical companies.

The prospect of investing early in a biotech company that may eventually be acquired by a pharmaceutical company sometime down the road obviously has a potentially large upside.

Companies that have spent a decade and hundreds of million dollars on R&D and drug development have already proven that they have a clear path to commercialization and so, in theory, have already been substantially de-risked.

But as Rahim also points out, sinking a lot of money into R&D can just as easily go up in flames without the clinical success necessary to bring a product to market.

Rahim and Next Edge focus on late-stage companies, noting that the factors that he looks for when evaluating biotech companies, aside from the fact that they’re addressing an unmet medical need, include the fact that they’ve quite often advanced through a decade of clinical development and so have already mitigated their risk, having spent hundreds of millions of dollars to develop these drugs.

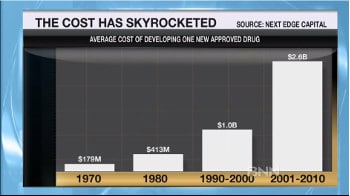

The barrier to entry for drug development has risen sharply over the years, with the average cost of developing a single new approved drug climbing from $179 million in 1970, to $413 million in 1980, $1 billion from 1990-2000, and $2.6 billion from 2001-2010.

The barrier to entry for drug development has risen sharply over the years, with the average cost of developing a single new approved drug climbing from $179 million in 1970, to $413 million in 1980, $1 billion from 1990-2000, and $2.6 billion from 2001-2010.

Asked about the particular companies in his portfolio, Rahim identifies several candidates that may be ripe candidates for M&A activity: Acadia Pharmaceuticals (NASDAQ: ACAD), Portola Pharmaceuticals (NASDAQ:PTLA), Intercept Pharmaceuticals (NASDAQ:ICPT), and Medivation Inc. (NASDAQ: MDVN).

In February, Acadia Pharma was at $18 per share and has since doubled in price, but Rahim believes that it can go substantially higher.

Acadia just got FDA approval, and will “probably this week” launch its selective inverse agonist drug, which mitigates the effect of psychosis in Parkinson’s disease patients.

“In the case of Acadia, Intercept and Portola, they have unique breakthrough drugs,” says Rahim. “They address substantial unmet medical needs. And in the case of Acadia, because of its mechanism of action, it’s able to address similar indications in schizophrenia and Alzheimer’s disease.”

“When you have a drug that’s able to expand its label beyond its approved label… you can have a market that is substantially above what you’re initially approved for.” – Eden Rahim

Listening to several Key Opinion Leaders addressing the Michael J. Fox Parkinson Foundation a couple of weeks ago, Rahim was struck by the tone they took when discussing Acadia’s Parkinson’s drug.

“The excitement was palpable,” he says.

“When you have a drug that’s able to expand its label beyond its approved label, as in the case with Acadia, and likely the case with Intercept for NASH, you can have a market that is substantially above what you’re initially approved for.”

NASH, or Nonalcoholic Steatohepatitis is an increasingly common liver disease, a sort of liver inflammation and damage caused by a buildup of fat in the liver, and though it resembles alcoholic liver disease, it occurs in people who either drink normal amounts or not at all.

The prospect of “timing the market” when it comes to companies that can literally take a decade between a research announcement and eventual drug approval, after a long sequence of clinical trials, is not easy.

So earmarking any company that may one day make attractive M&A targets for larger companies can be challenging.

“Companies that I’ve owned in the past institutionally included Centocor, for instance, which was acquired by J&J (Johnson&Johnson),” offers Rahim by way of example. “Well, Centocor was acquired because they were developing a drug called Remicade. J&J paid maybe $3 billion for Centocor, but Remicade today does $7 or $8 billion in sales annually. A little over a decade ago, AMGen acquired Immunex. And they acquired Immunex to get Enbrel, which is in the process of being launched. Well, Enbrel is now over a quarter of AMGen’s sales, and their other 15 products account for the rest of the sales, so you can see the benefits that accrue from them.”

Looking at past examples makes it sound easy, but watching an early placed bet pay off today is obviously no less satisfying for Rahim.

“Medivation was our largest holding,” he says. “It’s moved from $30 to $60 and it’s been flatlining there for a couple of months because there is a bid on the table. There is speculation, because it’s substantially above the offer price, that a white knight will come in, and there are two or three companies that are currently looking at it. But the premium that will be paid from $60 won’t be a 30% or 40% premium. It will likely be a 10% or 15% premium. So you’re looking at something that will be maybe $10 or $15 above.”

Watch Eden Rahim on BNN here.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment