The pivot.

It’s one of those tech aphorisms that conceals as much as it shows. It can mean “hey, we had no idea what we were doing at first”. It can also mean “a little company named Google decided to play in our space”.

Sometimes, however, a pivot happens because management has genuinely identified an opportunity that dwarfs the one they were looking at before.

Such is the case with Edmonton-based OneSoft Solutions Inc. (OneSoft Solutions Stock Quote, Chart, News: TSXV:OSS). OneSoft is a spinoff of Serenic Corporation, a firm that designed accounting software for non-profits and sold its operating subsidiaries in 2014. But opportunity presented itself in the form of establishing its new operating subsidiary, OneBridge Solutions Inc., and pursuing a piece of intellectual property that promises to offer disruptive new technology that will enable pipeline operators to better manage their aging infrastructure. Need to check defect growth data on your pipeline in Michigan? OneBridge Solutions will let you do that from your smartphone in Istanbul. Have to review a real-time dashboard of cost assessment or risk reports as part of your C-suite responsibilities? OneBridge Solutions provides state-of-the-art business intelligence and analytics for the lifecycle of your assets. Want to replace the drudgery of manually manipulating complex numbers and algorithms in spreadsheets to assess the integrity of your pipeline? OneBridge Solutions automates this process using Machine Learning and displays results with interactive 3D visualizations that anyone can intuitively understand.

OneBridge Solutions takes advantage of cutting-edge software tools such as Big Data (we’re talking petabytes on a normal day) and Machine Learning, and it’s already attracting the right kind of attention. During the fall of 2015, more than 721 companies from 50 countries applied to participate in Microsoft Venture’s Accelerator program for Machine Learning and Data Sciences. Eleven companies, including OneBridge Solutions, were selected to participate in it.

With their development sprint with Microsoft in Seattle about to wrap up, Cantech Letter sat down with management to talk about the company’s ambitious plans to introduce its new cloud technology that they believe will help to improve safety and efficiencies for the pipeline industry and disrupt the legacy systems being used today. We spoke with OneBridge Solutions President Tim Edward, OneBridge Solutions U.S. President Brandon Taylor, OneSoft CEO Dwayne Kushniruk, and CFO Paul Johnston.

Guys, can you tell us a bit about OneBridge Solutions?

(Brandon Taylor) I think, the best place to start is with our company tagline: “OneBridge Solutions: Flow Forward”. Our vision is to provide oil and gas pipeline companies with new and advanced software solutions to bring business intelligence to their existing infrastructure data and information.

We will eliminate existing manual processes and we are developing predictive analytics utilizing existing customer data, by integrating Machine Learning and other cutting edge technology from the Microsoft cloud platform and services. This will have huge benefit for public safety, business economics, environmental protection, resource conservation, and the like.

(Tim Edward) From our customers’ perspectives, this means streamlining compliance and reporting in a highly-regulated industry, which should eventually lead to lower systemic costs and improved relationships between their business, regulators and the public. This should also result in greater public confidence in the industry.

There are a number of reasons we will create a better outcome for customers. First, we will improve the costly and complex legacy processes through the use of better, cheaper, faster and more reliable data. We are also able to unlock data from legacy systems and processes to make it easier to interpret, share and act-upon. Third, we can simplify and automate complex and time-consuming tasks, which frees up staff to add value in other ways. Our systems can help improve risk exposure and liability by providing higher-confidence reporting of accurate and timely information about their pipeline infrastructure. And last but not least, we believe our systems can provide senior leadership with strategic, data-based views of key business processes, which enables better decisions associated with resource maintenance, planning and capital investments.

From a technology perspective, our differentiation from other software vendors who sell to this industry is stark and clear: we are using products and services within the enterprise Microsoft cloud platform and services that provide the most robust and secure environment on the planet –a platform that is continually evolving and being used to solve real business problems.

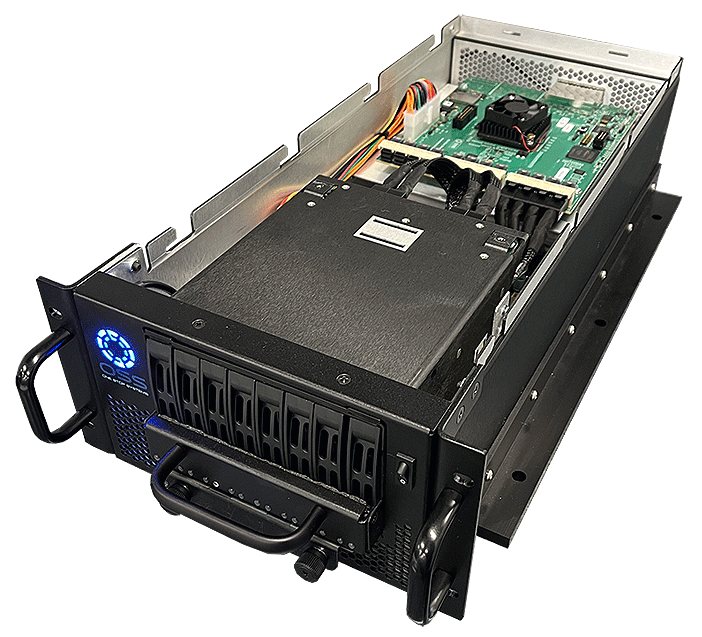

(Brandon Taylor) From a technology perspective, our differentiation from other software vendors who sell to this industry is stark and clear: we are using products and services within the enterprise Microsoft cloud platform and services that provide the most robust and secure environment on the planet –a platform that is continually evolving and being used to solve real business problems. We are using Machine Learning and pattern recognition to automate the complex and very labor-intensive tasks that are currently being used to normalize and match pipeline anomalies, which consumes a great deal of time and human resources. We have designed OneBridge Solutions to leverage the power of the Microsoft Cloud platform to process complex, unstructured data at scale, and to make this capability affordable to the industry without the need for significant investment by themselves in IT systems. Our ability to handle Big Data allows us to integrate multiple data sets and data systems like GIS, public safety, environmental, topographical, mapping, etc., to extend the value of our solution in many different ways.

Our customers can take comfort in the fact that we have tapped into the power of today’s leading data visualization platform by embedding Microsoft’s PowerBI (a premier business intelligence tool) to make it easy for non-IT experts to interpret data, to spot patterns and to determine answers to important questions quickly and intuitively. We also plan to extend the power of our solutions to Microsoft’s cutting edge devices and products like HoloLens, mobile devices, dash-boarding, etc., to bring data directly to the job site at all levels within the organization, by enabling everyone to be better informed with information that is relevant to them.

Tim, you are integral to the history of OneBridge Solutions. Can you tell us about that?

(Tim Edward) OneBridge was formed following OneSoft’s acquisition of IP and other assets that were owned by Bridge Solutions. In Bridge, I had been working on developing new software and processes for the oil and gas pipeline industry for more than 20 years. We decided that our best alternative was to merge the Bridge projects into OneSoft’s organization, which would provide a highly skilled and scalable software development team with expertise regarding Microsoft Cloud. Our vision is to introduce new born-in-the-cloud software solutions that our customers can use on-line, without the requirement for service consultants. This represents a real departure from current legacy systems which permeate the industry today, where a significant amount of service billings often need to accompany customers’ use of the software.

A second facet of our idea is to provide software as a service (SaaS) solutions, where our oil and gas pipeline clients can use a single database to manage all of the key components of their business, including public awareness, integrity management and risk management functions. This has not been possible to do with legacy systems, as this single database idea requires the capability to handle big (i.e., petabytes of) data. Big data can only be addressed with Cloud technologies which incorporate Machine Learning and other components of data sciences, operating on a highly scalable Cloud computing infrastructure. Microsoft is the leader in enterprise level Cloud technology, thus our decision to move our projects into the OneBridge/OneSoft organization.

Why did the company pivot away from the making of software for the not-for-profit space and into software for the oil and has sector?

(Dwayne Kushniruk) This question is best answered by taking you through the evolution of OneSoft as a company. Our involvement with NFP software commenced in 2004, when we acquired Denver-based Serenic Software, Inc. Consolidated annual revenues were about $1.5 million at the time of that acquisition, but increased after the acquisition to nearly $10 million in our fiscal year ending February 2008. We had state-of-the-art technology and the NFP market sector was ripe for new products, which set the stage for us to experience hockey-stick growth. What was particularly notable was that we were able to achieve substantial growth organically, and essentially using our own cash. Since 2002 we had conducted only two financings – a half million dollar financing at the time we acquired Serenic, and a $1.6 million financing in mid 2007 to increase working capital.

The situation changed abruptly in 2008 with the onslaught of the global economic crisis. Many of our NFP customers and prospects were unable to sustain their pre-2008 funding levels, which negatively impacted our business. We needed to change to defensive operating strategies, in order to maintain the business value we had been building. Revenues flattened post 2008, and subsequent year over year revenue growth remained minimal up until the time we sold the Serenic businesses in mid-2014. Because of our disciplined culture and strong fiscal management we were able to work through some long and tough years by focusing on customer retention, rather than pursuit of more risky initiatives to garner new customers in an environment that was non-conducive. Some of our shareholders agreed with our approach to prioritize on business value retention, while others were frustrated that their investment in our company was seemingly “parked” with no growth or liquidity event in site.

Beginning in 2011 we began to invest heavily into the new Microsoft Cloud platform and services, which now totals about $5 million to date. It became evident to us that Microsoft Cloud would fuel the next generation of software, and that we had the skills and expertise to leverage our advantage of being amongst the earliest adopters of Cloud. We also realized that it would be extremely difficult, and perhaps even detrimental to the business overall, to attempt to concurrently operate a legacy on-premise license and a Cloud business model. We had been seeking a merger or sale opportunity for the business since 2009, so were well-informed as to what fair value for the Serenic business represented. So when we found an opportunity to sell the legacy businesses in mid-2014 we did just that, while retaining the Cloud-associated IP and team that we believe has significant future value.

The reorganization of OneSoft also provided an opportunity for key personnel to re-invest in the Cloud start-up. The senior executive team and Board of Directors now collectively owns more than 50% of the shares of the company, which is advantageous for all shareholders – we aren’t simply managing shareholders’ money, we are also managing our own cash and investments.

We ended up distributing 45 cents per share of dividends and return of capital to our shareholders, which was approximately double the share trading price at the time we started to negotiate the Serenic sale in early 2014. While the deal didn’t represent a home-run, it did provide the opportunity to provide a decent return of capital to our shareholders who had waited a long time for their investment to perform. The sale also allowed us to press the re-set button and reorganize as a Cloud start-up company, whereby we could replace the prior defensive strategy with a much more offensive strategy to pursue Cloud software opportunities. Immediately following the Serenic sale we were able to launch out of the gate with a 4-year technology head start and a $3 million paid investment regarding our Microsoft Cloud IP, a continuing strong working relationship with Microsoft which we resumed post-sale, and no legacy hangover – as in the typical requirement to keep legacy products going for existing customers, processes and business models in place – in reality, we started OneSoft with a blank page of opportunity and few delimiters.

The reorganization of OneSoft also provided an opportunity for key personnel to re-invest in the Cloud start-up. The senior executive team and Board of Directors now collectively owns more than 50% of the shares of the company, which is advantageous for all shareholders – we aren’t simply managing shareholders’ money, we are also managing our own cash and investments.

Tell us about the IP and assets of Bridge. Why were they interesting enough to forgo your previous business plan?

(Dwayne Kushniruk) The short answer to your question is that the NFP opportunity represents only a fraction of what we believe our opportunity will be by focusing on OneBridge, for two main reasons. First, although we were able to successfully apply new Cloud technology and products to the NFP industry, we are hampered in fully competing in this marketplace because of non-compete terms that we entered into at the time we sold the Serenic opcos. Our initial plan was to create next-generation Cloud solutions and collaborate with the purchaser of Serenic for future joint benefit initiatives, however, that plan changed when it became clear that our objectives were misaligned. And without such collaboration, the segment of the NFP marketplace that we would be able to address without contravening the non-compete arrangement is too limiting.

Second, and most importantly, we believe that the opportunity for OneBridge to pursue the oil and gas pipeline marketplace is magnitudes larger than the not-for-profit software opportunity, with no dependency on or limitations imposed by third parties. This industry is ripe for change and improvement, and we have all of the development and deep domain expertise required to develop and introduce what we believe will be disruptive new technology and products for the pipeline industry.

Considering all factors, it made sense for us to exit the NFP marketplace, sell our NFP cloud assets, and focus fully on the OneBridge business. This, we believe, is in the best interests of all of our stakeholders, and will ultimately provide maximum value for our shareholders.

Isn’t it a bad time to be getting into the oil and gas sector, what with oil near decades-long lows?

(Tim Edward) The reality is that oil and gas must be transported for use by customers irrespective of what the price of oil happens to be. In fact, an argument can be made that tougher economic conditions may be better for the OneBridge business. We deal with aging infrastructure – 60% of pipelines in the USA were installed pre-1970. Pipeline companies want to improve their safety records and the reality is that it is more economical to maintain and repair existing pipelines than it is to build new ones. These companies are seeking more economical ways to manage and operate their pipelines to meet the ever-increasing safety standards and expectations that are being imposed by regulators and the public at large. Another factor is that it is now becoming mandatory in the US to manage gathering pipeline infrastructure, in addition to the distribution pipelines. We believe our new software solutions offer the best capability for pipeline operators to analyze their data that has already been gathered, in order to appropriately manage their assets and risks, and comply with regulatory requirements. Considering all of these factors, and given that our customers’ business is regulation-driven rather than by the current price of oil or gas, we see this as an ideal time to introduce the OneBridge solutions for this market.

Tim, you sold the Bridge assets for $762,647. That seems like a rather low price for a core asset OneSoft expects will generate tens or hundreds of millions for years to come. Why and how did you sell for a bargain on these assets?

(Tim Edward) I agree that the price tag for Bridge assets could appear to be undervalued. However, by merging our IP into the OneSoft organization, we have the opportunity to increase value quickly, because of the unique circumstances created by the merged resources. The Bridge vision was only a vision until it could be developed, tested and brought to market. This was always a daunting challenge for Bridge, as it is for the numerous other software companies who are slogging through development efforts to attempt to understand and work through new technology like Microsoft’s Cloud computing platform. Today, because we elected to sell the assets to OneSoft, OneBridge is now uniquely positioned to build out its products and solutions, because of the highly experienced Cloud technology team that OneSoft brings to the table, and also because of the significant contribution that Microsoft Ventures is now making to our projects. We are in a position today that very few software companies will ever achieve, and one that would not have occurred without OneSoft’s prior investment in Cloud technology and its long historical working relationship with Microsoft. Moving the Bridge opportunity into OneBridge truly represents a win-win situation for everyone, because we are now in a position to start deploying our solutions in a time frame of months rather than years.

(Paul Johnston) I just want to jump in with a comment regarding value. The Bridge assets we acquired were mostly components of Intellectual Property in a start-up company, which are challenging to value with certainty at time of acquisition. We understood that we were acquiring historical industry expertise, experience and customer relationships, as well as on-premise software products that would need to be re-developed as SaaS solutions operating on the Microsoft Cloud, and that a more precise value of the IP would ultimately only be revealed in the future, after the software has been re-developed for Cloud, introduced and accepted by the marketplace, and is able to generate consistent or growing revenue patterns. In the meantime, the numbers reflect our analysis of value at time of acquisition. We are currently preparing a more formal determination of value in accordance with International Financial Reporting Standards and the final number may change depending on the conclusions we derive from that work.

Before it was sold, your former company Serenic had a long-standing relationship with Microsoft. OneBridge Solutions may have already achieved a more elite and potentially more beneficial one. Can you tell us about that?

(Brandon Taylor) You are correct. In the Serenic days, commencing in 2009, we were involved in Microsoft’s Technology Adoption Program, or TAP. TAP was comprised of about a dozen partners who were selected by Microsoft from thousands of software companies world-wide, whose purpose was to meet regularly to discuss, review and debate alternatives for future Microsoft technologies and their application to business. This was beneficial to Microsoft in that TAP members were best positioned to advise Microsoft regarding end-user experiences with the Microsoft-based software systems that were continually evolving.

In 2011, we were asked to be part of Microsoft’s GR2R, or Global Road To Repeatability advisory team. This was the first iteration of the Cloud technology advisory team, which subsequently evolved to become the Microsoft Dynamics NAV Managed Cloud Services or MCS platform, which was unveiled to other Microsoft partners in 2015. OneSoft was actually the first company world-wide to launch products on the MCS platform and fully integrate its products with Microsoft Office 365. Our investment in Cloud technology commenced in 2011 and exceeded $3 million in Serenic prior to the OneSoft reorg and a further $2 million to date. Whereas some of our earlier work is now obsolete, we simply would not be where we are today without having been on the bleeding edge, as a very early adopter of the Microsoft Cloud platform.

During the fall of 2015, more than 721 companies applied to participate in Microsoft Venture’s Accelerator program for Machine Learning and Data Sciences. Eleven companies, including OneBridge, were selected to participate in it.

This history and background was instrumental in us achieving our latest win, that is, to have been selected to participate in Microsoft Venture’s Accelerator program for Machine Learning and Data Sciences. More than 721 companies from fifty countries had applied to participate during the fall of 2015, and were investigated in depth by Microsoft. That list was pared down to just under 30, who were invited to present their projects to Microsoft “juries” in mid-December, 2015. From this short list, 11 companies were selected to participate in the program, of which 10 actually commenced program. Interestingly, the 11th company got acquired between the Accelerator selection and commencement day.

So right now you and your team are actually in Seattle, Washington? What’s that like?

(Brandon Taylor)The Microsoft Ventures facility is situated across the street from Amazon, around the corner from Google labs, and a block away form the Tesla dealership – so very much a “Silicon Valley North” experience. We had little idea at the outset that “accelerator” would actually mean “light speed” in terms of the projects we are working on. We are about half way through our 4-month sprint at Accelerator, which includes technology as well as business and corporate development initiatives. The mentors we work with are second to none, and our access to the Microsoft technology experts has been remarkable. We have been able to accelerate our product development very significantly, because all of the potential show-stoppers that we have encountered have all been quickly resolved. My sense is that much of our progress in the past few weeks would have taken months or years, had we not had access to the Microsoft personnel and other experts who have been provided to support the objectives of the Accelerator program.

With regards to the key benefits of Accelerator –I estimate that our technology and product road map has been compressed to only a third of the time it would have otherwise taken to achieve, had we not been a participant in the Accelerator program. I am also convinced that the substance and quality of our underlying technology is significantly better than it would have been, had we not have had access to the product teams that were provided to us.

How do you plan to ramp OneBridge Solutions quickly? What is the sales strategy?

(Tim Edward) News of what we are creating is already finding its way amongst the industry in the U.S. We are continually fielding calls from potential customers, industry experts, and even some of the regulators who are following our progress. I believe that once we are in a position to demonstrate the software solutions that we are developing, that prospective customers will become actual customers, with little resistance. Our solutions will provide a high degree of functionality that legacy systems simply cannot provide, and do so at very cost-effective pricing.

Many or most of our potential customers are enterprise level organizations who typically attend various industry sponsored information sharing events like seminars, trade-shows and the like. We intend to present our new offerings at these events, and anticipate that we will be able to reach the vast majority of our potential customers by doing so. We also have a wide network of contacts developed from our long experience in this industry. We believe that OneBridge products are sufficiently unique within the industry to be perceived as highly valuable, such that attracting new customers is not expected to pose a significant challenge.

What kinds of margins should investors expect to see from your business once it is mature?

(Brandon Taylor) The big advantage of deploying cloud software solutions are their scalability and ability to be continually enhanced and evolved without impacting our customers and having to update software at customer sites and manage the myriad of on-premise issues and the numerous hardware configurations that different customers utilize on premise. All of this contributes to a highly efficient and cost effective infrastructure at OneBridge, which increases margins and the bottom line. We also believe that our SaaS delivery model will create more recurring revenue than the traditional on-premise licence model.

Ultimately, by analyzing very large amounts of industry data, we believe we can train Machine Learning to evolve its pattern recognition so that we can start predicting potential pipeline failures.

You have raised some capital recently. Will it be enough to take you to profitability?

(Dwayne Kushniruk) Based on what we see today, we expect to start generating revenue within the next couple of quarters, with an expectation that OneBridge will achieve profitably within the next two fiscal years. At this point we anticipate that revenue that will come in from early adopter customers, and this, coupled with cash on hand, will be sufficient to execute our business plan as envisioned.

What do you hope to accomplish in the next 12-18 months?

(Brandon Taylor) From a technical perspective, our most immediate short term objective is to demonstrate our initial OneBridge product at the Microsoft Venture’s Demo event scheduled for June 2, 2016. This will be a full-scale presentation of the Accelerator projects by all participating companies, which we expect will be presented to an audience of approximately 250 people which include invited industry experts, technologists and investor groups. Microsoft also plans to stream the event live. Following the culmination of this Accelerator sprint, we have identified our next two development sprints and are now in the process of actively seeking customers to participate in private preview use of our software through October of this year. We expect their input to assist us to further enhance our solution, which we expect to release to market this fall. Ultimately, by analyzing very large amounts of industry data, we believe we can train Machine Learning to evolve its pattern recognition so that we can start predicting potential pipeline failures.

We have taken the “IoT” approach – the Internet of Things – which essentially provides access to all facets of information and data that our customers and their personnel need to operate their business, all of which is accessible real time with any Internet-capable device. The IoT approach allows us to continue to enhance our solutions with functionality that our customers require to resolve the issues that they address on a daily basis, from anywhere on the planet.

(Tim Edward) I’ll answer this from a customer perspective … our vision for OneBridge is a smart infrastructure play – to provide all of the software functionality that our customers need to manage their pipeline assets. Our objective is to create software that is so advanced that it will become disruptive to the industry (and by that we mean replace the current methodologies of analyzing pipeline data) and become the de-facto system of choice. Today’s systems require a high ratio of consulting services costs to initial software system acquisition price – 5 to 1 or even 10 to 1 of consulting services to implement software functionality. We believe that the intelligent design of our software, coupled with Machine Learning and other automated Data Science components, can change that paradigm and provide our customers with greatly improved software solutions to better manage their pipeline infrastructure.

(Dwayne Kushniruk) From an investor perspective, we believe that OneSoft is second to none with respect to opportunity at this point. We have succeeded in merging the Bridge vision and IP with the huge opportunity within the oil and gas pipeline industry, and are now poised to leverage our expertise with the Cloud platform and to accelerate our technological and corporate development efforts with Microsoft Ventures. To have all of this history behind us, a billion dollar plus addressable marketplace ahead of us, and a significant head-start amongst potential competitors – this is an exciting place to be.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment