The Canadian Venture Capital & Private Equity Association has released their 2015 Canadian Private Equity Market Overview, outlining the strongest figures for start-up fundraising since 2008, at $2.25 billion over 536 deals.

Information and communication technology (ICT) accounted for $1.37 billion of that total, over 325 deals, led by Lightspeed’s $61 million U.S. ($79 million Cdn.) funding round, led by Caisse de dépôt et placement du Québec.

While ICT made up two-thirds of 2015’s totals, CVCA CEO Mike Woollatt told BNN earlier today to keep an eye on life sciences, which are on their way up particularly in terms of per-deal dollar value, and cleantech, which is on its way down along with everything related to the oil and gas sector.

“The biggest portion is Internet or SaaS software services,” said Woollatt. “You see it on mobile, and you see it on e-commerce. Those are big categories. We see it across the board. We see substantial growth in innovation on the ICT side. The number of companies, the number of targets, available on the venture side for people who invest in Canada has never been bigger.”

2015 was also a big year for tech IPOs, perhaps skewed a little by Shopify’s nearly $1.6 billion valuation.

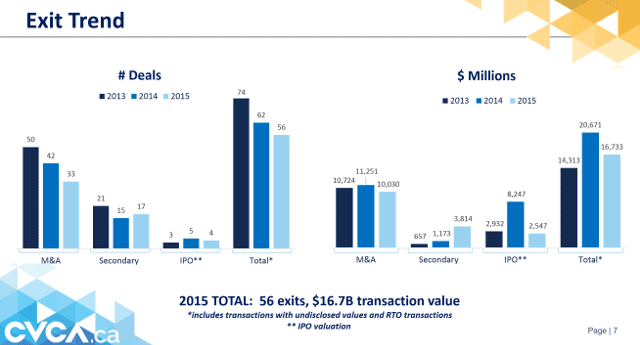

Exit trends tell a mixed story, however, with 2015’s $16.7 billion transaction value falling from 2014’s $20.6 billion, and up only slightly over 2013’s $14.3 billion in total exits, including M&A, IPO, and reverse takeovers.

In fact, forecasts for 2016 tend to signal very light IPO activity, with most major players, or companies of the same vintage and cohort as Shopify, such as Hootsuite, Vidyard, Lightspeed and Vision Critical, delaying an IPO until 2017.

The slumping Canadian dollar has generally had a good effect, particularly on Canadian SaaS companies whose operations and staff are paid for in Canadian currency while collecting the majority of their revenue in U.S. dollars.

A diving loonie, however, has exacerbated a recurring problem for Canadian start-ups and mid-sized technology companies, which has been the hunt for talent.

Silicon Valley, or any American city with a start-up scene, has been much more lucrative for Canadian tech workers, and that talent crunch is likely to worsen for firms that can’t afford to pay their workers in American currency.

Before anyone gets too excited that because 2015 was such a dramatic increase over 2014, then that must necessarily mean that 2016 will be a monster year for the innovation sector in Canada, there are lots of indicators around that signal a slowdown in venture capital activity ahead.

John Vrionis, general partner with Menlo Park-based venture capital firm Lightspeed Ventures described the venture capital market in the U.S. as “in a bit of a correction period” speaking last week with the San Jose Mercury News.

“Like with most businesses, the venture capital party got a little bit over-heated,” said Vrionis. “People were cognizant of that, but sometimes it’s hard to stop. It comes to a point where people realize it’s gone too far and they put on the brakes,” adding, “You see it start in the public markets and it gets reflected all the way back to the venture capital ecosystem.”

What anyone can see in the public markets right now in Canada is a sense of tightening up and caution, rather than an opening of venture capital floodgates.

Noting that there’s still an emphasis on funding early-stage or seed-level funding rounds, Woollatt told BNN, “One of the concerns we have going forward, frankly, is that ability to scale these companies when they get to that later stage.”

It’s the mid-level fundraising, getting from a company that’s not much more than an incubator pitch to the level of Shopify that’s proving to be a challenge in Canada.

“A lot of companies just plateau; they just can’t get over that hundred-million-dollar valuation,” said Chad Bayne, a partner in the Toronto office of law firm Osler, Hoskin & Harcourt LLP to the Globe & Mail recently. “To basically build small little companies that get taken out effectively for their teams and not their technology, that’s not exciting. And that’s not what as Canadians we should be striving for.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment