This report was adapted by Cantech Letter from a piece prepared by Sophic Capital. For the original report, and more in-depth research, please visit Sophic Capital’s website, here.

Despite strong demand, high sticker prices due to costly battery systems have stunted electric vehicle purchases. We believe that government incentives will drive greater adoption as well as increased R&D spending by electric vehicle and battery manufacturers to decrease battery costs. Lithium ion batteries are leading this revolution, and we believe that once they become commoditized in electric vehicles, utilities will implement these batteries in energy storage systems.

Batteries are the unappreciated hero of electronic devices. All hand-held devices (mobile phones, power tools, cameras, etc.) need batteries to power them. While some batteries are chargeable and others are disposable, all are indispensable.

Climate change concerns have focused a spotlight on electric vehicles (EV). Consumers and governments demand electric-powered vehicles as alternatives to traditional fossil-fuel engines. In fact, the U.S. government believes that transitioning light duty fossil-fuel vehicles to hybrid (half fossil-fuel, half electric) and pure EVs could reduce foreign oil dependence and greenhouse gas emissions by a minimum of 30% each. However, legacy battery technologies are unsuitable for EVs given their unfavourable capacity, storage, form factor, and weight characteristics.

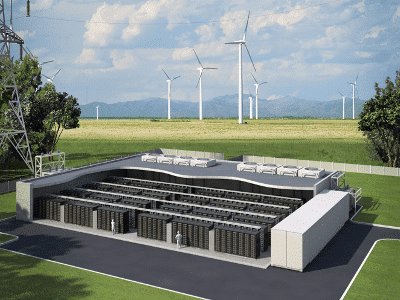

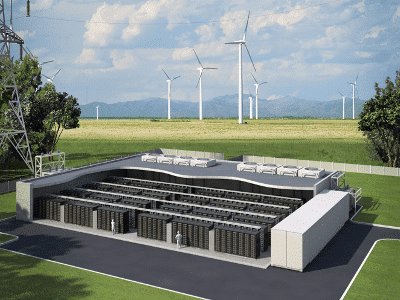

Green energy has made power grids more unstable, but energy storage systems (ESS) can help. Power generation is largely an issue of demand; electricity must be produced at the exact same time it is used. And when green energy generation is not constant or reliable (clouds block solar panels, tempered wind speeds cause wind turbine rotation to slow), fossil-fuel- and nuclear-based generation take up the slack. What utilities need is a way to store unused green energy in order to minimize the reliance on traditional power-generation fuels. ESS designed with lithium-ion batteries is about to help.

We believe that lithium-ion batteries (LiB) are the future to widespread EV adoption. Why LiB? Because LiB offers capacity, charging, weight, and form-factor benefits attractive to EV manufacturers. And although LiB costs are currently high, we believe that pricing will fall as battery and EV manufactures invest in LiB R&D in order to meet surging consumer EV demand.

We believe that LiB pricing will fall due to surging demand in the EV sector, causing utilities to adopt LiB-based ESS. As history has shown, mass adoption of technology causes that technology’s cost to fall. The move to LiB is well underway in the EV sector, and we believe LiB costs will continue to decrease. We further believe that once this occurs, utilities will accelerate their implementation of LiB for ESS.

LiB Global Market Forecast

Source: J.D. Power

The global LiB market was worth $11.7 billion in 2012 and is expected to double by 2016*. We believe that EVs (led by adoption in the United States, as shown in Exhibit 1) and power grid storage will drive this growth, with consumer electronics demand leveling due to the near saturation of LiBs in these devices already. In the meantime, global demand for EV batteries was 5,662MWh in 2013 and could reach 31,100MWh by 2016. Solar storage in the U.S. is forecasted to grow from $42 million in 2014 to $1 billion by 2018.

*It is also used in cosmetics, pesticides, and paint strippers.

Worldwide EV sales could see double digit growth. The global market saw over 700,000 EVs in 2014, and by 2021, there could be over 21 million EVs, representing a 50% CAGR. South Korea could see the fastest average annual growth rate at 115%, followed by Australia (105%), and then China (81%).

South Korea and China dominate the LiB market because these two countries will see the highest growth of EVs. The Chinese government has a plan to put 500,000 EVs on the road by 2015 and five million EVs by 2020 (although the data in Exhibit 1 is not as optimistic.) As a result, Korean LiB manufacturers Samsung SDI and LG Chem have invested invest hundreds of millions of dollars in new Chinese battery plants (scheduled to open in 2015) to meet the Chinese government’s goals. Keeping with our theme that government incentives spur demand, the South Korean government provides a 15 million won (~C$16,000) subsidy on top of subsidies ranging from 3 million to 8 million won (~C$3,300 to C$8,900) subsidies provided by 10 major cities and jurisdictions. And as we stated earlier, globally South Korea could see the fastest, average EV growth rate at 115% per annum from 2014 through 2021.

Battery Overview

How does a battery work? A battery stores chemical energy and converts it to electrical energy on demand. Connect a battery to a flashlight, for example, turn on the flashlight, and a chemical reaction occurs that produces electrons within the battery. These electrons flow into the flashlight and illuminate the bulb. Over time, the battery’s components degrade causing weaker chemical reactions. Eventually, the battery wears out and needs replacing.

Even chargeable batteries wear out. Chargeable batteries contain a special cell that helps to reverse the discharging effects of the battery’s chemical reactions. This special cell is why chargeable batteries command a higher price and a reason why EVs are expensive. And although chargeable batteries can sometimes undergo hundreds discharging/charging cycles, they too eventually wear out.

Source: Aexon Power

Not all chargeable batteries are created equal (Exhibit 2). Lead-acid batteries are the oldest type of chargeable battery and are typically used in motor vehicles. They have excellent energy-to-weight ratios, are inexpensive, but suffer from gas buildup and degradation if left unused. For better reliability and less weight, EVs have used nickel-metal hydride batteries. But nickel-metal hydride batteries are about twenty times more expensive than their lead-acid peers. To help lower the cost, the weight, and the capacity of EV batteries, manufactures have turned to LiBs.

LiB Costs Must Decline to Make EVs Price Competitive

Consumers bought almost 5 billion LiBs for their electronic gadgets, in 2013. Given the small capacities required in consumer electronic devices, manufacturers absorbed higher LiB costs in order to provide consumers with lighter (lithium is the third lightest element), thinner, and longer powered devices.

EV manufacturers cannot ignore the benefits that LiB offer over other battery compositions. Today’s LiBs hold more than twice as much energy and cost ten times less than when they first appeared in 1991. They offer higher power-to-weight ratios, high energy efficiency, light weights, and superior temperature and discharge characteristics over lead-acid and nickel-metal hydride batteries.

So why are EV manufacturers interested in LiB? Government incentives and the need to wean away from fossil-fuel reliance have spurred consumer demand. However, sticker shock prevents many consumers from purchasing EVs. To meet demand and lower EV pricing, EV and battery manufacturers are investing in R&D to squeeze possibly another 30% of capacity by weight. Should they succeed, this optimization could reduce the volume and weight of LiBs and make EV pricing competitive to combustion engine vehicles.

Government Incentives May Spur Demand & Lower LiB Costs

History repeats itself in adopting technology. Over the past decades, we have seen government and tax code incentives fuel demand and technology R&D. These incentives have resulted in increases in processing power, bandwidth, memory, and reduced semiconductor sizes; all at lower costs to the consumer. Now, governments are providing incentives for consumers to adopt EVs. As a result, consumer demand for EVs is increasing which, in turn, is helping to fuel LiB development.

Source: Lawrence Berkeley National Laboratory, Tracking the Sun VI, July 2013

History has repeated itself within the green energy space. Although U.S. government incentives for solar panel installation are not as lucrative as they once were, we believe that they helped to spur initial demand. Exhibit 3 illustrates a parabolic increase in demand after 2006, which coincided with the passage of the residential renewable tax credit. As a result of the increased demand, median costs for grid-connected solar panels in the United States declined from 1998 through 2012 (Exhibit 4). We believe the declining costs were not only due to falling solar module prices but also lower prices on associated installation components.

Source: Lawrence Berkeley National Laboratory, Tracking the Sun VI, July 2013

The International Council on Clean Transportation (ICCT) has verified that government incentives spur EV consumer demand. ICCT claims, “Norway’s fiscal incentive of about 11,500 EUR per BEV [battery electric vehicle] (equivalent to about 55% of vehicle base price) is associated with a 6% market share for BEV in 2013, and a 90% market share increase from 2012 to 2013. Similarly, the fiscal incentive in the Netherlands of about 38,000 EUR for PHEV [plug-in electric vehicle] (equivalent to about 75% of vehicle base price) in 2013 is associated with a 5% market share for PHEV in 2013, and a 1,900% market share increase from 2012 to 2013.”

We believe history will repeat itself within the green energy sector, and LiB prices will fall. The U.S. government has offered a tax credit worth up to $7,500 for EVs purchased during or after 2010 (California adds up to another $2,500). France offers €7,000 if a vehicle meets a carbon emission threshold, and a similar program in Sweden offers about €4,500. The Ontario government provides an incentive worth up to C$8,500. China also provides a bonus ranging from €4,200 to €7,200 for qualified vehicles. We believe incentives such as these are enticing consumers to consider the purchase of EVs.

Source: Company press releases

Incentives could be driving LiB R&D. With government incentives increasing demand, EV manufacturers appear to be struggling to fulfill EV consumer needs. The reason: We believe EV pricing is still high for the average consumer ($57,500 for a Tesla 70D model.) EV and battery manufacturers, we believe, have reacted by investing in R&D (Exhibit 5) in order to bring LiB costs down to where EVs become economical alternatives to traditional fossil-fuel powered vehicles.

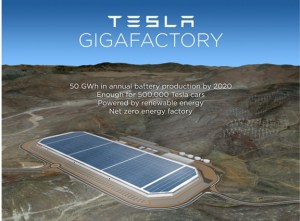

Tesla Motors is certainly on board with EV R&D and manufacturing. On September 4, 2014, Tesla Motors announced a $5 billion investment in a LiB plant. Tesla chose Nevada to build the plant, called “The Gigafactory,” which Tesla expects will manufacture 50GWh of annual capacity by 2020 – enough for 500,000 Tesla cars. Tesla CEO Elon Musk stated that the plant could drive down LiB costs by 30% through scale. The EV manufacturer has successfully promoted its EVs; but the cars are more than hype because in 2013, Tesla’s Model S won Motor Trend’s Car of the Year award for being “one of the quickest American four-doors ever built” and being “perhaps the most accomplished all-luxury car since the original Lexus LS 400”.

Tesla isn’t the only big auto manufacturer that needs LiBs. Nissan, Renault, Ford, GM, Audi, Toyota, Honda, Daimler, BMW, Mitsubishi, Fiat, Hyundai, Kia, Volkswagen, Porsche, Volvo, Zenn Motors; all of these auto manufacturers make EVs. EVs are mainstream, and we believe that the growth of this market will carry LiB manufacturers along for the ride.

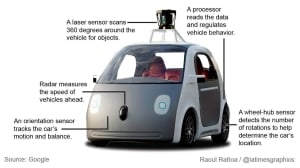

Google (NASDAQ:GOOG) has been vocal about its self-driving car. But the Company has also been investigating new battery technologies. Google’s self-driving car runs on electricity (currently supplied by LG batteries), so it’s not hard to extrapolate that the Company’s future battery technology could power its vehicles. We can’t say whether or not LiB technology is Google’s focus (although The Wall Street Journal raises the possibility); however, to us, Google’s interest in battery technology for EVs is another data point that validates this space. EVs are not a distant dream but a certain reality.

Google (NASDAQ:GOOG) has been vocal about its self-driving car. But the Company has also been investigating new battery technologies. Google’s self-driving car runs on electricity (currently supplied by LG batteries), so it’s not hard to extrapolate that the Company’s future battery technology could power its vehicles. We can’t say whether or not LiB technology is Google’s focus (although The Wall Street Journal raises the possibility); however, to us, Google’s interest in battery technology for EVs is another data point that validates this space. EVs are not a distant dream but a certain reality.

We note that rumours exist concerning an Apple (NASDAQ:AAPL) car named project Titan. Fiat Chrysler Automobiles CEO Sergio Marchionne met with Apple CEO Tim Cook and stated

Source: U.S. Department of Energy, EV Everywhere, page 8

that Cook was “interested in Apple’s intervention in the car”. This followed Tesla CEO Elon Musk’s comments that Apple getting into the car business “would be great”. Add another data point.

Even President Obama is on board with LiB research and development. In March 2012, President Obama announced the EV Everywhere Grand Challenge to produce plug-in electrical vehicles that are as affordable as fossil-fuel vehicles by 2022. A major part of his initiative is reducing LiB costs.

Utilities Will Likely Adopt ESS Once LiBs are Commoditized

Utilities need ESS to match grid output to consumer demand. Green energy output is unstable. Clouds block the sun’s energy hitting solar panels, and wind velocity is never constant for spinning wind turbines. Factors such as these cause fluctuations in power that can cause outages. Germany’s green power generation is so unpredictable that neighboring countries have installed switches to disconnect from Germany’s grid. ESS offers a way for utilities to smooth out grid volatility by capturing excess green energy and allowing consumers to tap into this energy storage when green energy sources wane.

Utilities need ESS to reduce greenhouse emissions. The volatility of green energy output has caused increased greenhouse gas emissions in some parts of the world. For example, Germany utilities shuttered many gas-fired plants as their solar and wind power output ramped. But when these green energy sources couldn’t cope with excess demand, utilities burned cheap coal to fill the void. ESS would allow utilities to capture green energy when supply exceeds demand and reduce the reliance upon traditional power generation fuels.

Although many utilities have deployed ESS, they haven’t adopted LiB-based systems. Pumped hydro, where water from an upper reservoir flows downhill to spin a turbine which in turn pumps the water back to the upper reservoir, accounts for 95% (or 23.4GW) of the U.S. grid storage projects. Thermal storage is second followed by battery storage systems.

Globally, LiB ESS is practically non-existent. Research firm IHS estimates that in the 2012 to 2013 timeframe, only 340MW of grid connected ESS was installed globally. The firm forecasts that ESS storage will grow to 6GW by 2017 – with LiB accounting for the majority of the projected installations – and 40GW by 2022. MarketsandMarkets projects the market could grow from $4 billion in 2012 to $10 billion by 2018.

Many LiB ESS projects are underway. South Korea and Japan respectfully have 54MW and 30MW of LiB ESS projects underway. Sony Corporation and Hydro-Québec, Canada’s largest electricity producer, launched Esstalion Technologies Inc., a joint venture that will research and develop high-capacity LiB ESS for power grids.

But when will utilities adopt LiB-based ESS en masse? Utilities are adopting ESS on a small scale, and we believe that wide-scale adoption will occur once LiB technology matures and costs decline. We base this belief on what has happened in the technology sector in the past – for example, demand drove microprocessor and DRAM development resulting in lower end-user costs. Once LiB becomes mainstream for EV, we believe that utilities will embrace LiB-based ESS.

Smart Cities could Push Utilities Quicker

Frost & Sullivan forecasts that the smart city market could be worth $1.5 trillion by 2020. MarketsandMarkets projects the global smart city market to grow from $411 billion in 2014 to $1.1 trillion by 2019. Broadly speaking, a smart city is a concept of connecting citizens and government, fostering sustainable growth, and making infrastructure efficient. The latter of these is what interests us. Smart grids are a part of what makes infrastructure efficient.

Source: U.S. Department of Energy

BCC Research forecasts that the total smart grid market will grow from $38 billion in 2013 to $61.9 billion in 2019. Smart grids are two way communication systems that monitor power generation and demand in order to anticipate and optimize the distribution of electricity. In order to match supply to demand, many smart grids implement energy storage systems. There are different types of energy storage systems (flywheels and pumped water), and increasingly, utilities are turning to the evolving battery space. The idea is the same as storing renewable-generated energy – smooth out demand requirements. And as renewable energy generation has a slew of public and private initiatives, so do smart grids.

We believe the reasons for government interest are simple: Global infrastructure is old and power blackouts harm economies. For example, power outages and substandard power quality issues cost the U.S. economy between $119 billion and $188 billion annually*. We note that this estimate was published a year after Y2K had passed – but it’s the best info that we could find. So given that big bucks are at stake when ancient power distribution systems fail, you can bet that politicians are interested in securing power lest they risk the wrath of “powerless” constituents pelting them with rocks and garbage.

*David Lineweber and Shawn McNulty, The Cost of Power Disturbances to Industrial & Digital Economy Companies, June 29, 2001, pg. 7

Source: SmartGrid.gov

The U.S. Department of Energy’s Smart Grid Demonstration Program allocated about $1.6 billion to 32 projects demonstrating smart grid technologies. Sixteen of the projects are for energy storage projects, of which 10 involve some form of battery technology. Two of these battery projects evaluate LiB ESS and are collectively worth about $61 million.

Tesla, again, is doing its part. At the end of April 2015, the Company announced that it would enter the home and business storage business. The Company plans to offer the Powerwall, 7 and 10 kWh ESS, meant to connect to solar panels, which owners can use for load shifting (moving power from one part of the grid to another), power back-ups, and increasing power consumption (in the case of solar energy generation). Within a week, Tesla had over 38,000 pre-orders. A few days later, AGL Energy (ASX:AGL) announced that it would provide a 6kWh home storage solution.

Tesla also plans to offer a 100kWh ESS for utilities. Utilities can group these units to scale the capacity from 500kWh to 10MWh.

The Dominant LiB Manufacturers are in Asia

LG Chem (KRX: 051910) is primarily engaged in petrochemical manufacturing. However, the Company also makes batteries for consumer electronics and LiBs for EVs. LG Chem’s LiBs are featured in Hyundai Sonata, GM Volt, and Renault Zoe models. It has also struck deals with SAIC Motor in China and Germany’s Audi. In July, 2014, the Company announced a plan to invest hundreds of millions of dollars – through to 2020 – in a Chinese manufacturing facility scheduled to open at the end of 2015. LG Chem expects the plant’s capacity to supply more than 100,000 EVs. We believe this capacity will support LiB supply agreements with Chinese auto manufacturers SAIC Motor and Qoros. Reports also suggest that LG Chem could benefit from Nissan’s plan to curtail in-house battery manufacturing.

Panasonic (TYO: 6752) formed a partnership with Tesla Motors for the EV manufacturer’s planned 50GWh Gigafactory, beating Samsung SDI and LG Chem in the process. Panasonic plans to invest about $1.4 billion in the plant. LiB output is projected to supply 500,000 EVs per year by 2020. From 2011 through 2013, Panasonic supplied Tesla with approximately 200 million LiB cells.

Source: LG Chem Ltd.

AESC is a joint venture between Japan’s Nissan (51% ownership) and NEC. Established in 2007, AESC focuses on researching and developing LiBs for the EV market. AESC’s primary plant, located in Zama, Japan, is responsible for manufacturing LiBs for Nissan’s Japanese LEAF facility.

Samsung SDI (KRX: 006400) is a leader in battery technology and ESS. The Company has expanded from its displays business into battery manufacturing and battery systems. On July 1, 2014, the Company acquired Cheil Industries Inc., a chemical manufacturer, to help expand the reach of the battery business through Cheil’s supply chain. During July 2014, BMW agreed to spend “billions” to purchase Samsung SDI’s batteries for the auto manufacturer’s i3 and i8 series vehicles. On August 16, 2014, Samsung SDI signed a preliminary deal with China’s Sungrow Power Supply Co Ltd to form a joint venture which would make ESS. During the same month, the Company announced a $600 million investment to break ground on a Chinese automotive battery plant, expected to supply enough batteries for 40,000 EVs.

U.S. Dominates LiB and ESS Outside of Asia

Johnson Controls (NYSE:JCI) was the first company in the world to produce LiBs for EV mass production. In January 2014, the company sold its Auto Electronics Unit so that it could focus on core businesses, including the continued development and manufacturing of LiBs for EVs.

Tesla Motors (NASDAQ: TSLA) recently announced a $5 billion investment in a LiB plant. On September 4, 2014, Tesla Motors announced that it had chosen Nevada to build the plant, called “The Gigafactory,” which Tesla expects will manufacture 50GWh (enough for 500,000 Tesla cars) of annual capacity by 2020. Tesla’s CEO, Elon Musk, stated that the plant could drive down LiB costs by 30% through scale.

EnerSys (NYSE: ENS) is a dominant American stored energy manufacturer that has supplied the U.S. military for 48 years. The company has made acquisitions in the lithium-ion space, notably Quallian for $30 million in 2013, and a minority interest in EAS Germany GmbH, a joint venture formed with GAIA Akkumulatorenwerke GmbH to manufacturer large-format LiBs.

BASF Catalysts converts base materials into catalysts that control vehicle emissions. This division of BASF (FRA:BAS) also has a battery segment targeting LiB technology. BASF forecasts its targeted battery materials market to reach at least €5 billion by 2020 and has committed to investing a triple-digit million euro sum to develop this business. To support this objective, the company opened America’s largest cathode materials manufacturing facility in Elyria, Ohio.

U.S. Government is Long LiB but with Mixed Results

The U.S. government was motivated to create a battery manufacturing industry. Five years ago, most EV batteries were manufactured in China. Recent estimates suggest that in 2012, 85 to 90% of LiB production originated in China, Japan, and Korea with LG Chem, Panasonic, and AESC occupying 70% of the market share. Worried about a shift of dependence from foreign oil to foreign batteries plus the lure of creating U.S. jobs in a growing sector, the U.S. Department of Energy (DOE) awarded $2 billion of grants to 29 battery companies to create a domestic LiB industry to fuel the EV sector.

The U.S. government was motivated to create a battery manufacturing industry. Five years ago, most EV batteries were manufactured in China. Recent estimates suggest that in 2012, 85 to 90% of LiB production originated in China, Japan, and Korea with LG Chem, Panasonic, and AESC occupying 70% of the market share. Worried about a shift of dependence from foreign oil to foreign batteries plus the lure of creating U.S. jobs in a growing sector, the U.S. Department of Energy (DOE) awarded $2 billion of grants to 29 battery companies to create a domestic LiB industry to fuel the EV sector.

Some DOE grant recipients went bankrupt – lack of demand for EVs because of cheap gasoline was the likely culprit. EnerDel won a $118.5 million DOE grant, but only collected about half before going bankrupt not long after a major customer declared bankruptcy. A123 Systems received $132 million out of a $249 million grant (plus $100 million in Michigan tax credits) before filing for bankruptcy due to lack of demand and a costly recall of defective batteries.

But out of the ashes rises the occasional phoenix. Lio Energy Systems (“Lio”) was a privately-held joint venture between by China’s Tianjin Linshen Battery Joint-Stock Company and CODA, a U.S.-based Chinese EV company. CODA wanted to reduce its dependence on sourcing LiBs from China and the plan was for Lio to supply LiBs from a Columbus, Ohio plant. The company waited two years for a $500 million DOE loan before abandoning plans for the plant. CODA filed for bankruptcy in 2013 but reemerged with a focus on ESS.

Nissan succeeded in localizing its LiB production. Nissan has a LiB plant in Smyrna, Tennessee backed by a $1.4 billion U.S. DOE loan. The plant was built to make up to 200,000 battery packs per annum with most directed its LEAF EV assembly plant in Tennessee. However, Reuters speculated that Nissan may close the plant which the company denied, and the plant continues to operate.

Batteries for a Green Environment Aren’t so Green Themselves

Many battery manufacturers use n-methyl-pyrrolidone (NMP) to coat LiB electrodes (the metal parts that contact the battery’s chemicals and allow electrons to flow.) The process involves adding liquid NMP, a compound linked to birth defects, to a powder needed to coat the electrodes. The NMP and the powder are mixed into a mush and stuck to the electrode. Then, the coated electrodes are dried in a furnace to evaporate the NMP and solidify the powder. The drying process creates toxic gases that need to be captured to meet the environmental standards of numerous jurisdictions.

Are environmental regulations a motivating factor to decide where to manufacture LiB electrodes? As stated in the preceding paragraph, LiB electrode manufacturing consumes NMP, a toxic liquid. This process requires a large capital investment, has high operational costs, and must meet environmental guidelines for the collection of poisonous gases. Exhibit 8 shows health, environmental, and safety regulatory bodies that monitor NMP. Noticeably absent are any regulatory agencies from South Korea and China. Although we are not suggesting Korean and Chinese LiB manufacturing and environmental protection are substandard to North American and European practices, the lack of government NMP oversight begs the question: Are LiB and auto manufacturers sourcing LiB electrodes from Asia?

![Exhibit 8: NMP[2] is a “Popular” Toxin with Regulatory Bodies Source: Dawn Speranza Grauke, Around the World Chemical Tour, Intel Corp., July 13, 2011, pg 7; Sophic Capital](https://www.cantechletter.com/wp-content/uploads/2015/06/16-291x300.jpg)

Source: Dawn Speranza Grauke, Around the World Chemical Tour, Intel Corp., July 13, 2011, pg 7; Sophic Capital

New Canadian LiB Players are Emerging

Electrovaya – Cleaning up the Industry

Electrovaya (TSX: EFL) is an emerging leader in the EV and ESS spaces following a recent acquisition that increased the Company’s manufacturing capacity and added new separator technology (a separator separates a battery’s electrodes). The Canadian-based company announced relationships with China’s DongFeng Motor Group and Scottish Southern Energy Power Distribution. Electrovaya holds over 150 patents worldwide, and we believe its non-toxic (non-NMP) manufacturing is what gives the Company a competitive advantage.

On April 29, 2015, Electrovaya closed a transformational acquisition. The Company acquired the assets of Evonik Litarion GmbH, which has a state-of-the-art manufacturing facility capable of producing 0.5 gigawatt-hours of lithium-ion electrodes. The Company stated on its most recent conference call that the acquisition came with €2.7 million of cash (Evonik plans to give another €3 million due to some financial changes), €7.2 million of inventory, and approximately €80 million of tangible assets. Plus, Litarion came with a profitable contract that has a $30 million annual revenue run rate. The contract expires at the end of the year.

So what did Electrovaya pay for this transformational acquisition? Believe it or not, €1 million. We can only speculate about why these assets were so cheap; the German government was likely motivated to preserve jobs. European LiB production is almost non-existent, due to strict environmental and onerous electricity costs. Most LiB batteries are sourced from Asia, where the costs are far less – the $30 million contract is likely sourcing batteries from Asia after the contract expires at the end of 2015. Electrovaya’s NMP-free manufacturing process reduces material handling and power costs – management claims it can manufacture LiB electrodes for less than Asian competitors. The German government may have viewed Electrovaya as the means to save only jobs but also an industry.

But how will Electrovaya pay for the plant conversion to its non-NMP process? During a conference call, Electrovaya’s management noted that the Litarion plant has “four or five” NMP–based production lines. Management presented a plan to convert these lines over the next year to Electrovaya’s non-NMP manufacturing process. The conversions will be staged across the production lines so not to disturb the current output. Management noted that the German government has an interest in seeing the conversion completed, and Electrovaya does “not expect shareholders to pay.” This suggests that the German government may provide Electrovaya with some sort of funding, which may be grants and/or debt funding.

On May 6, 2015 Electrovaya announced that it entered into a supply agreement with Leclanché S.A. for the manufacture and commercialization of lithium ion storage systems incorporating electrodes from Litarion. Electrovaya commented, “We are confident that the combination of our high performance electrodes together with Leclanché´s outstanding cell assembly know-how will lead to joint commercial success.” Leclanché is shifting from supplying only the electric vehicle market to now focusing on the emerging market for energy storage systems and industrial applications.

The acquisition also came with a proprietary ceramic embedded composite separator SEPARIONTM, which is protected by 300 global patents. This separator and intellectual property may be another hidden asset, which only recently became more publicized with the announcement of an order worth over $1 million from a leading Chinese battery manufacturer. Management expects the customer will require over $1 million worth of separators for the balance of 2015, and the amount could grow in 2016.

Until this Chinese battery manufacturer order, SEPARIONTM was exclusive to a leading German automotive company’s electric vehicle production. Although this auto company continues to be a major customer, it no longer has exclusive rights. In a recent press release Electrovaya stated, “Several major battery companies are expressing great interest and have begun the qualification process. China is moving into electric vehicles with higher energy density chemistry, and SEPARIONTM gives the needed safety. We estimate that China alone can absorb over $15 million of SEPARIONTM in 2016.” While the initial order and management’s comments look promising, we believe further deals will lend credibility to future management forecasts regarding separator revenues.

We believe EV and ESS manufacturers will demand both cost advantages and safety. Recent recalls at several large auto manufactures have demonstrated that the costs associated with faulty products can be high and harmful to brands. Although we are not in a position to independently confirm that Electrovaya’s new separator provides increased safety, management’s comments and the initial order look promising. Obviously further SEPARIONTM orders would increase our, and likely the markets’, confidence that this technology could provide another large opportunity for the Company.

Consolidation in the Market Increases Leaders Market Share

Asahi Kasei (TYO:3407), a chemical company, announced in February that it was purchasing Polypore’s ESS division to expand its battery business for $2.2 billion. Polypore sells battery membranes to the three largest auto makers as well as Tesla and Panasonic. Polypore had $442 million in ESS sales and $116 million in EBITDA. We believe that Ashai Kasei was the leader in the separator market and Poypore was number three when the acquisition was announced.

What we find interesting about this acquisition is that Polypore produces a “dry process” separator that lowers battery costs. A separator is a membrane placed between battery electrodes in order to isolate them yet allow for ions to flow between them. Polypore’s separators are a good fit for Asashi’s existing HiPore business that makes a polyolefin, flat-film membrane for LiB separators. Polyolefin does not emit harmful gases when incinerated, making it an attractive separator for LiBs. The addition of Polypore’s “dry process” demonstrates that clean manufacturing is the way to go, and that battery companies will pay for the technology.

Nano One Materials – A Story Charging Up

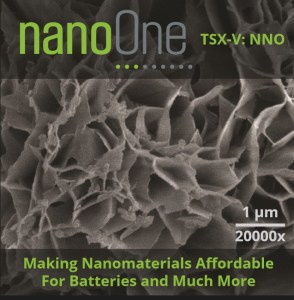

Nano One Materials Corp. (TSXV: NNO) has developed a scalable process for manufacturing low-cost, high-performance energy storage materials for batteries. Founded in 2011, Nano One Materials believes that it can reduce the cost of battery cathode materials (the negative terminal) and increase performance. Following its recent listing on the TSX Venture exchange, the Company is cashed up and continues to develop its technology and move toward commercialization.

Nano One has an innovative and unique approach to improving LiBs; it changes the way the materials are made and addresses cost, performance, and commercialization limitations in manufacturing. Think of Nano One’s approach as a chemical assembly line; a manufacturing platform that is agnostic to different types of LiB materials. This gives Nano One flexibility to adjust to market trends and enables the Company to position the technology as a viable means to commercialize new, emerging, battery materials and eventually other materials markets.

Nano One has an innovative and unique approach to improving LiBs; it changes the way the materials are made and addresses cost, performance, and commercialization limitations in manufacturing. Think of Nano One’s approach as a chemical assembly line; a manufacturing platform that is agnostic to different types of LiB materials. This gives Nano One flexibility to adjust to market trends and enables the Company to position the technology as a viable means to commercialize new, emerging, battery materials and eventually other materials markets.

Nano One is using lower grade feedstock (~30% less) and easier processing (~75% fewer steps and 3 to 4 times higher throughput) to produce cathode materials with improved charging, cycling, and capacity. The Company’s material takes a faster charge and has been shown to store 2 to 3 times more energy over the lifetime of the battery. For complex materials, Nano One’s technology can complete a production cycle in less than a day, compared to four to seven days using traditional methods. These combined produce 90 to 95% yields, fewer failure points, longer lifetime, consume fewer harmful solvents, and create a safe product compared to peer processes.

EV battery packs are built with excess capacity, partly to increase longevity and warranty periods. If Nano One’s technology can improve the longevity of the energy storing materials that make up battery pack cells, then EV manufacturers could benefit from fewer cells, faster charges, less weight, less cost, longer warranty periods, and increased mileage. We believe that all of these benefits would boost EV adoption rates.

Nano One has six patents pending in the U.S. and six in foreign jurisdictions. The Company has validated materials at Canada’s National Research Council and reportedly with other first tier battery materials producers. Nano One has an industrial commercialization partnership with BC Research and its parent NORAM Engineering that are working on the conceptual design of a full commercial facility. This will bring credibility to commercialization discussions with strategic partners and will also inform the design of a pilot plant scheduled for 2016. The pilot will demonstrate and de-risk scale-up while providing a platform to develop new materials and generate revenue.

Risks of the Space

LiBs explode. All batteries have the potential to explode, especially if they overheat. However, we believe the recent incidents with LiB fires were blown out of proportion. Earlier this year, Tesla’s CEO, Elon Musk, stated that fires have affected about 1 out of 10,000 Tesla vehicles. To put this in perspective, from 2008 to 2010, the United States averaged 194,000 highway vehicle fires annually, and about 44% (85,000) of these were caused by electrical malfunctions or failure. There were a quarter billion vehicles on American roadways in 2010, meaning that fires caused by vehicle electrical malfunctions or failure were about 3.5 times larger than Tesla vehicle fires.

Source: ChargePoint

EV charging infrastructure required. We view this as low risk because: a) charging networks exist and are being expanded, and b) in keeping with our theme that government incentives spur adoption, the U.S. DOE is investing $5 billion to electrify America’s transportation sector. In 2011, about 2,000 charging stations existed in the United States. Today, there are about 9,500 charging stations and 24,300 charging outlets in the United States. Tesla Motors has stated that it aims to have charging stations available to 98% of the American and Canadian populations by 2015. ChargePoint has a head start on Tesla (Exhibit 9) – the Company claims a network of 21,000 EV charging stations that’s expanding by over 500 charging ports each month. Overseas, China’s lack of charging infrastructure has prompted Tesla to discuss the possibility of deploying a network of no-fee charging stations. And across the EU, there are approximately 14,700 charging stations and an EU strategy to increase this number to 800,000 by 2020.

Charging LiBs takes longer than filling a tank with gas. This is true, however, fast charging stations can charge an EV to about 80% capacity in less than 30 minutes.

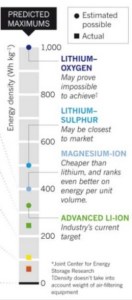

LiB becomes obsolete. As previously mentioned, LiBs could potentially yield an additional 30% of energy capacity by weight. We doubt that consumer demand for chemical energy will level once LiBs are commoditized. Battery technology will continue to evolve with new compounds and new configurations. These developments are already underway: Researchers are experimenting with germanium compounds, carbon nanotubes, and silicon nanoparticles. But, for now, lithium is king.

Conclusions

We believe consumer adoption of EV is about to ramp, largely due to government incentives to purchase EVs. In order to meet demand and make EVs cost competitive with fossil-fuel powered vehicles, battery technology must improve capacity, storage, form factor, and weight characteristics. Lithium-ion batteries are at the forefront of this revolution with South Korean and Chinese manufacturers dominating the industry.

Once LiB costs for EVs decline, we believe utilities will implement LiB-based ESS to smooth the generation irregularities inherent with green-power sources. This adoption will reduce reliance on fossil-fuel power generation, provide customers with more reliable power, and should prove lucrative for LiB manufacturers.

One drawback to LiBs is that they consume NMP, a toxic liquid used during the manufacturing process. Many jurisdictions regulate the use of NMP causing some LiB consumers to abandon their manufacturing plants or consider sourcing their LiBs from South Korea and China, two countries with less strict NMP regulations.

Disclaimers

The particulars contained herein were obtained from sources that we believe to be reliable, but are not guaranteed by us and may be incomplete or inaccurate. The opinions expressed are based upon our analysis and interpretation of these particulars and are not to be construed as a solicitation of offer to buy or sell the securities mentioned herein. Sophic Capital Inc. (“Sophic Capital”) may act as financial advisor, for certain of the companies mentioned herein, and may receive remuneration for its services. Sophic Capital and/or its principals, officers, directors, representatives, and associates may have a position in the securities mentioned herein and may make purchases and/or sales of these securities from time to time in the open market or otherwise.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment