Euro Pacific Canada analyst Rob Goff believes Espial (Espial Stock Quote, Chart, News: TSX:ESP) is positioned to capitalize on the shift by telcos to IPTV and by TV makers to smart TVs. But he says there are three things investors should be watching closely.

Euro Pacific Canada analyst Rob Goff believes Espial (Espial Stock Quote, Chart, News: TSX:ESP) is positioned to capitalize on the shift by telcos to IPTV and by TV makers to smart TVs. But he says there are three things investors should be watching closely.

Yesterday, Espial reported its Q4 and fiscal 2014 results. For the year, the company earned $1.17-million on revenue of $20.0-million, a topline that was up 59% over 2013.

Goff, who last July made Espial one of his top picks, says the company’s fourth quarter, in which it generated EBITDA of $600,000 on revenue of $5.3-million, was essentially in-line with his forecast. In a research update to clients today, the analyst maintained his “Buy” rating and one year target of $4.30, implying a return of 36.5% at the time of publication.

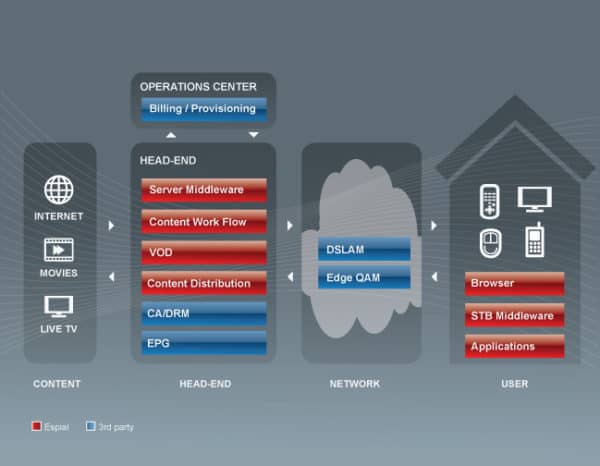

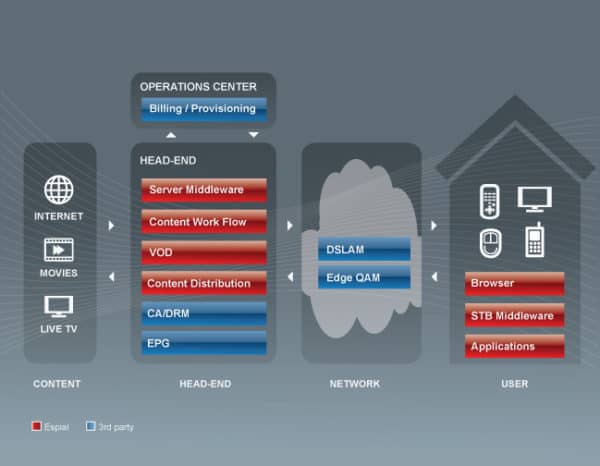

Reflecting on a move that has seen shares of Espial rise by more than 180% over the past year, Goff notes that the company “is not an overnight success”. He points out that by the company’s estimates it has invested more than $100-million, or $5 a share on its IPTV service capabilities in the past eight years.

Today, Goff says investors looking at Espial should focus on three things.

First, the analyst says Espial must answer the question of whether its management can execute. “Product strength is not seen as the key hurdle,” says Goff. Instead, the analyst points to management’s acknowledgement that its toughest task will be client concerns about the company’s relatively small size.

The second thing to watch, says Goff, is what Espial will do with all the money it has. “Oh to have this problem!” remarks the analyst. Goff says he is modeling Espial generating free cash flow of $56.6-million or $2.11 a share between 2015 and 2020. He says this money could be used for acquisitions.

The final thing investors should watch closely, says Goff, is takeover speculation. The analyst says candidates include Cisco and the U.K-based Pace, but an under the radar suitor is SeaChange International (NASDAQ:SEAC), a Massachusetts based company whose management has expressed interest in an acquisition that fits Espial’s profile. He notes that the top five equity holders of Espial are public funds or private equity, and that their collective stakes total 40% of the company’s shares.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment