A growing library of content combined with the emergence of over-the-top service providers such as Netflix has put DHX Media (TSX:DHX) in an advantageous position. But increasingly, it’s what the Halifax-based company is doing with that content that is driving value.

With its stock making regular new highs since 2012, DHX Media has become a market darling.

The company, which focuses on children’s programming, owns heavyweight brands such as Yo Gabba Gabba!, Teletubbies and Inspector Gadget. It’s a good time to own properties like this as traditional and emerging digital distribution channels are duking it out for hours and half-hours of programming, while the number of connected devices worldwide soars. DHX has inked distribution deals with Disney, Netflix, Amazon and Viacom, amongst others. But the company is also making hay with what it calls “brand development”; branching the content it owns out to various forms and mediums.

The latest example of this came Monday, when DHX signed a new deal with a U.K. toy company called Character Options to make plush, plastics and bath Teletubbies toys. The arrangement will work hand-in-glove with the broadcast of a 60-episode series of Teletubbies that has been commissioned by the BBC’s children’s programming brand, CBeebies.

“Teletubbies is one of the most recognizable preschool brands globally which we believe represents a remarkable consumer products opportunity,” says DHX Brands EVP Peter Byrne. “We’re very excited to be partnering with Character Options, who have an incredible track record in building and nurturing preschool brands for the long term.”

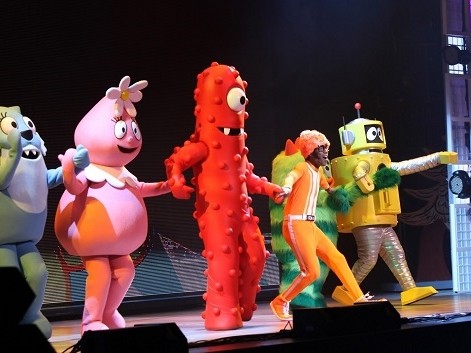

The Teletubbies deal comes on the heels of the company’s announcement of the company’s fifth consecutive annual Yo Gabba Gabba! Live! tour, which will visit 29 U.S. cities, plus Toronto, between October 14th and December 7th.

Euro Pacific Capital analyst Rob Goff, who has a “Buy” rating and $8.00 one-year target on DHX Media says he is watching deals such as this closely, particularly new deals the company might make with properties such as In the Night Garden and Yo Gabba Gabba.

“The merchandising from these properties could significantly add to our baseline forecasts,” noted the analyst in a research update to client yesterday. Goff says deals like the Teletubbies toy deal can be lucrative, often carrying upfront payments and minimum guarantees. “It would be reasonable to speculate a multi-million dollar minimum guarantee paid over time,” he adds.

Global Maxfin Capital’s Joseph MacKay, who currently has a “Buy” rating and a one-year target of $8.50 on DHX Media, agrees. He thinks the Teletubbies deal “should result in meaningful revenues” for the company.

Founded in 2006, DHX Media, whose names derives from the merger of Decode Entertainment and the Halifax Film Company, boasts a library of over 8500 half-hours of film and television. The company, which has grown organically and through acquisition, grew its fiscal 2013 revenue to $97.26-million, up nearly 34% from the $72.65-million topline it posted a year prior.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment