Word on Wall Street is that Hootsuite Media Inc. is set to take an investment from Boston-based mutual fund management firm Fidelity Investment, according to an anonymous source cited by the Wall Street Journal, paving the way for an eventual IPO.

Word on Wall Street is that Hootsuite Media Inc. is set to take an investment from Boston-based mutual fund management firm Fidelity Investment, according to an anonymous source cited by the Wall Street Journal, paving the way for an eventual IPO.

According to the “person familiar with the matter” sourced by the article, Hootsuite is negotiating a crossover financing deal with Fidelity, in which an investor who usually only invests in publicly listed companies will make an exception for a privately held entity as a pre-emptive move to hedge the potential loss of missing out when the company does IPO.

The rationale being that if a privately held company can be “valued” in the same way as a publicly listed company, then the risk of investment becomes less than holding off until it’s too late. But as the Wall Street Journal makes clear, “valuing” a privately held company is exceedingly difficult, with neither Hootsuite’s potential valuation, nor the size of Fidelity’s investment made clear in the article. Some sources, however, have pegged the company at around $725 million.

The strategy of getting in ahead of IPOs seems to be something of a trend for Fidelity, who last year led a $225 million funding round for Pinterest, the social media scrapbook platform.

Earlier this summer, Fidelity led a $1.2 billion (with a “B”) funding round for grey-market taxi industry disruptors Uber, valuing the company at a potential $18 billion.

It’s become a sport in Canada over the past year, speculating about which of approximately five companies with roots in the sudden and recent rise of start-up culture, which emerged more or less as a direct response to the economic downturn of 2008, will be the first to go public.

In January at the Cantech Investment Conference, heavy hitters such as John Ruffolo, Mike Edwards and Mark McQueen mused on stage about whether it would be Shopify, Beyond the Rack, Hootsuite, Desire2Learn or maybe Vidyard to be the first to achieve the escape velocity necessary to IPO.

Last year, Hootsuite famously raised the largest funding round for a software company in Canadian history, at $165 million, led by OMERS Ventures, Insight Venture Partners and Accel Partners.

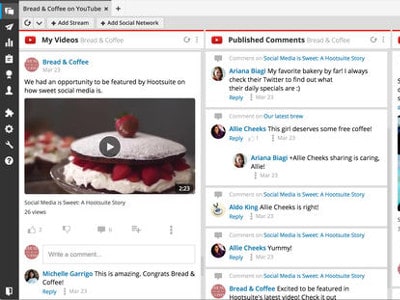

Hootsuite has more than 500 employees and about 9 million users, with plans to add 100 more employees during a “HootHire” event next week.

Spokespeople from Hootsuite and Fidelity both declined comment for the Wall Street Journal article, unlike the “person familiar with the matter” cited. Perhaps Ryan Holmes’ dog Mika is the anonymous source. While dogs are, of course, famously loyal, we also know that they will do anything for a measly treat.

Holmes, in a cagey non-denial denial, posted the following to his Twitter feed earlier today.

i can neither confirm nor deny…

— Ryan Holmes (@invoker) August 25, 2014

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment