Espial (TSX:ESP) is staring down a “considerable” opportunity in the disruption of the cable business, says Haywood Securities analyst Massimo Voci.

In a report to clients this morning, Voci initiated coverage of Espial with a “Buy” rating and one-year target of $4.25, implying a return of 37% at the time of publication.

Voci says IPTV, satellite, and over-the-top services such as Hulu and Netflix have disrupted the cable business. He cites one report that says cable revenue will decline by $13-billion between 2013 and 2020. The analyst theorizes that this will drive innovation in the historically staid cable industry.

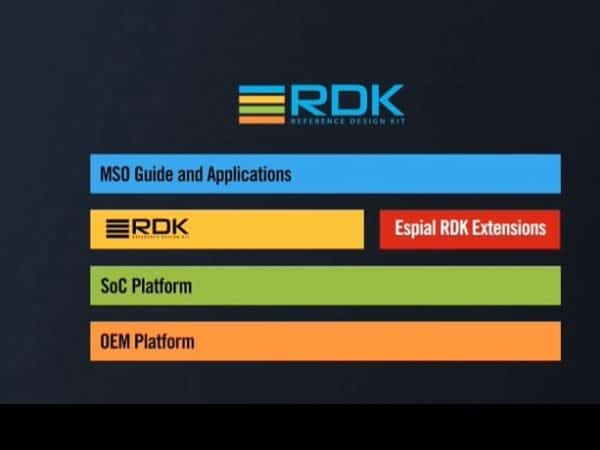

One likely option for cable operators is that they will double down on the Reference Design Kit (RDK), a freely available plaftom that was born from a a joint-venture between Time Warner and Comcast. RDK, which standardizes the development process for set-top boxes, gateways and connected devices, plays right into Espial’s wheelhouse, says Voci. The analyst notes that Espial made an early commitment to RDK, and is already in discussions with 25 of the world’s top 60 cable operators.

The market opportunity for Espial’s RDK-based solutions, says Voci, is “considerable”. He believes that the 25 potential clients the company is currently talking to represent $500-million in license revenue and $100-million in maintenance and support revenue annually.

Another part of Espial’s business is its Smart TV browser software, which it has licensed to Panasonic and Sharp, amongst others. While this is a smaller part of the company’s business, Voci notes that it has seen greater traction of late and should benefit from increasing shipments of Smart TVs.

Voci says the risks in Espial’s business are a long sales cycle, the potential of a new entrant in the space, and if RDK sees limited commercial adoption or if Espial cannot effectively penetrate the market.

Voci thinks Espial will generate EBITDA of $2.7-million on revenue of $19.2-million in fiscal 2014, and $5.6-million in EBITDA on a topline of $25.7-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment