A changing of the guard.

The struggles of BlackBerry-maker Research in Motion are better than well-documented, they have been cataloged in an almost gleeful manner by a financial press that seems to forget that similar dark clouds once hung over current tech stalwarts such as Apple and IBM.

While RIM’s revenue has fallen in what it describes, perhaps too charitably, as a transition period between its BlackBerry 7 and BlackBerry 10 Platforms, the company’s share price has been skewered, falling from $148 midway through 2008 to well under $10 today.

This past summer, the tumble saw RIM replaced as Canada’s most valuable tech stock. The Waterloo-based company is still tops in terms of revenue, but investors clearly feel the prospects of companies such as CGI Group and Catamaran are more compelling. Those watching the sector closely, however, will know that these companies did not simply back into first place, they have been riding a wave of their own success for several years. Catamaran (formerly SXC Health) in fact, was number one on Fortune’s 2011 “100 Fastest-Growing Companies” List, a honor that was bestowed up RIM in 2009.

While two stocks rank higher than Research in Motion, the rest of the billion dollar TSX techs have been very active, and will look to send RIM further down the list. At least one analyst, however, says don’t count the BlackBerry-maker out just yet. Here are Canada’s largest tech stocks, ranked according to their market cap on September 28th, 2012.

1. Catamaran Corp. (TSX:CCT)

Market Cap: $9.87-billion

Catamaran’s trajectory is simply unparalleled in the recent history of Canadian tech. As late as 2004 the Milton, Ontario-based company was plodding along more than a decade after it was founded with just $33 million in revenue. There was no big, splashy Bay Street IPO; the company went public in a reverse takeover of a publicly listed shell, allowing it to raise a relatively meager $10 million in 1997. In February, however, the company (which was then known as SXC Health) reported its fiscal 2011 result. The numbers surprised even its most ardent supporters. The company’s revenue grew a whopping 155% to $5 billion, from $1.9 billion in 2010, and earnings were up too, increasing 45% to $166.4 million. Although it’s not a household name in a consumer market space like RIM, results like these mean Catamaran, which moved its head office to Chicago after listing on the NASDAQ in 2006, will continue to garner attention on the international stage.

2. CGI Group (TSX:GIB.A)

Market Cap: $6.83-billion

CGI was founded in Montreal in that city’s Olympic Year of 1976. The Company’s name is an acronym for Consultants to Government and Industry. Midway through 2010, CGI picked up Stanley, an Arlington, Virginia based systems integrator for a billion dollars. But the company was just getting started; on August 20th, CGI completed the largest acquisition in its history, picking up London-based Logica Plc, a company that was actually larger CGI, for $2.64-billion. CGI Group now ranks as the sixth largest independent information technology and business process services firm in the world.

_______________________

This story is brought to you by Serenic (TSXV:SER). Serenic’s cash position as of May 31st, 2012, $4.45-million, was greater than its market cap as of September 6th, which was $3.86-million. The company has zero long-term debt. Click here for more info.

_________________________

3. Research in Motion (TSX:RIM)

Market Cap: $3.94-billion

A bump last week after its Q2 numbers weren’t as bad as expected was a rare piece of news that wasn’t received terribly by the street. RIM has seen its share price fall to decade lows as its market share has eroded ahead of the launch of its BlackBerry 10 operating system, which CEO Thorsten Heins believes will vault the company back into mobile contention. Cormark analyst Richard Tse says the Waterloo-headquartered company is by no means out of the woods yet, but should be commended for growing its subscriber base with an aging product portfolio. More importantly, he says, the report is evidence that management is is executing operationally on changes it has laid out.

4. OpenText (TSX:OTC)

Market Cap: $3.17-billion

OpenText, which got a new leader last December when former Rackable boss Mark Barrenechea took the reigns, grew out of a collaboration between the University of Waterloo and the New Oxford English Dictionary, the project was a partnership with the Oxford University Press to computerize the Oxford English Dictionary. This engineers on this project realized that it required developing search technologies that could be used to quickly index and retrieve information. The search technology they developed, which incorporated full-text indexing and string-search technology, was recognized as being useful for other electronic applications. In 1991, at about the same time the Internet was emerging, the results of this project were commercialized by a private spin-off called OpenText Corporation. Today, the company competes with the likes of Oracle and Microsoft in the lucrative Enterprise Content Management space. A year ago, OpenText joined Research in Motion in the Waterloo billion dollar club, reporting fiscal 2011 revenues of $1.03 billion.

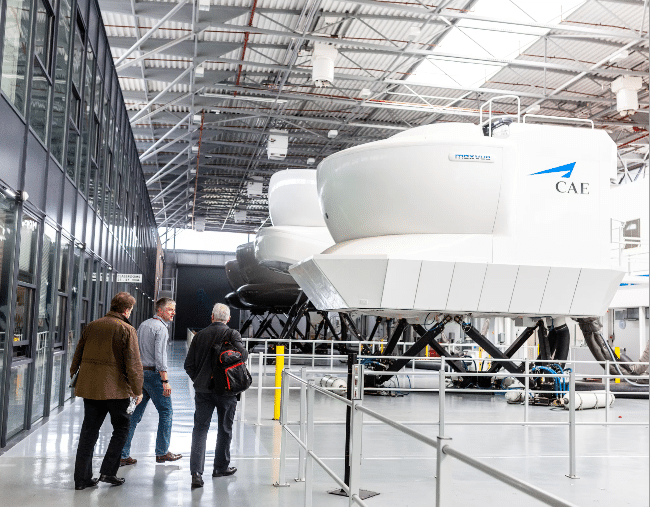

5. CAE, Inc. (TSX:CAE)

Market Cap: $2.72-billion

CAE Inc., which was founded in 1947 in Saint-Hubert, Quebec has built its considerable business on the back of flight simulators. The company is the gold standard in the industry, having sold their simulators to over a hundred different airlines. CAE now trains more than 75,000 crew members each year, many at its at 426,000 square foot facility at the Dallas/Fort Worth International Airport, the largest business aviation training facility in the world. And while its its still small in terms of its overall revenue, CAE is also now showing the ability to win business in its new healthcare initiatives. In March of 2010, the company acquired three medical simulation product lines from Immersion (NASD:IMMR), which it said would form the core offerings of CAE Healthcare’s newly established surgical simulation division. In fiscal 2012, annual revenue from the company’s “New Core Markets” division, which includes its mining and healthcare initiatives, were slightly less than 10% of total revenue, at $83.0-million, but was up 118% from the $38.0-million topline its posted in 2011. Out of this world: Macdonald Dettwiler is the prime contractor for a spectrometer geology instrument called APXS, which allows NASA’s Curiosity rover to calculate the chemical composition of the rocks and soil on Mars.

6. Constellation Software (TSX:CSU)

Market Cap: $2.2-billion

Toronto-based Constellation was formed by current CEO Mark Leonard, who left the world of venture capital in 1995 to form the company, which has since become one of the most profitable and successful Canadian companies. Constellation, which makes software for the public and private sector, is clear about its strategy. The company grows through acquisition, looking to acquire best of breed companies across different verticals. Constellation is involved in various niches on the public and private side from software for housing authorities, transportation agencies, and software for large home builders. On the strength of this strategy, the company has grown its revenue from just $243 million in fiscal 2007 to more than $773-million in 2011.

7. Macdonald Dettwiler (TSX:MDA)

Market Cap: $1.64-billion

On June 27th, Macdonald Dettwiler announced it would pay (US) $875-million plus cash dividends and other payments from Space Systems/Loral, which the company expected to be in excess of (US) $135-million. Dan Friedmann, MDA’s president and CEO said the transaction, which essentially doubled the size of his company, was “game changing”. The Richmond, BC company, which was formed in 1969, was a pairing of the efforts of John MacDonald and Werner Dettwiler. Since then, MDA has been a part of the fabric of Canadian technology. The aerospace giant’s contribution to the Canadarm, a robotic space arm developed in the 1970′s to repair and service NASA space shuttles, is iconic. But the company has since been forced on the rocky road of reinvention. MDA’s very recent activities will be more familiar for those who had followed the company in its halcyon days. The company is the prime contractor for a spectrometer geology instrument called APXS, which allows NASA’s Curiosity rover to calculate the chemical composition of the rocks and soil on Mars.

8. Celestica (TSX:CLS)

Market Cap: $1.49-billion

Assembling Blackberrys, as well as other consumer products such as XBoxs and iPhones, was once Toronto-based Celestica’s bread and butter. But the IBM spinoff saw continual valuation woes as its electronics manufacturing services faced increased competition from China. This meant margins in an already difficult business were becoming razor thin. More recently, Craig Muhlhauser a former exec with Ford and GE who joined Celestica in May 2005, has looked to move the company up the value chain to replace the business it recently ended with RIM, which was as much as 20% of Celestica’s total revenue. Muhlhauser says Celestica is now adding jobs because it is winning business in sectors where the absolute bottom line price is less important than reliability and overall cost of ownership.

9. Evertz Technologies (TSX:ET)

Market Cap: $1.01-billion

Dieter Evertz founded his eponymous company in 1966, before selling to a group that included current bosses Romolo Margarelli and Doug DeBruin, who came over from Leitch Technologies. The Company went public in 2006, raising $67 million in a TSX IPO. Evertz remains as one of the last public companies standing from a once robust Canadian broadcasting technology sector. The company’s fiscal 2011 revenue of $293.4-million came from a product line that includes timecode equipment, closed captioning technology and multiviewers. Evertz’s products have been used in the production of Star Wars III, Rocky 6, CSI, Oprah and the 2008 Olympics.

________________________

_________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment