Byron Capital analyst Douglas Loe says the lawsuit between Tekmira and Alnylam, which is scheduled to be heard in Massachusetts court in October presents a “lingering risk” for Tekmira, but this risk is being offset by reduced clinical risk for all siRNAs.

Byron Capital’s Douglas Loe says that while the trial was small, the data resulting from it was meaningful.

In fact, says the Byron Capital healthcare analyst, this was “the most dramatic “knockdown” data we have seen in clinical studies for a LNP-formulated SiRNA drug.” He points out that ALN-TTR02 “knocked down TTR protein levels in serum by up to 94% (in one high-dose patient) and 86% – 88% in six other subjects treated with slightly lower dose.” In a research update to clients recently, Loe maintained his Speculative Buy rating on Tekmira, but raised his target price on the stock to $6.25 from his previous $4.

_____________________________________

This story is brought to you by Agrimarine (TSXV:FSH). Not all salmon farms are the same. Click here to learn how Agrimarine is meeting consumer demand for sustainable aquaculture.

______________________________________

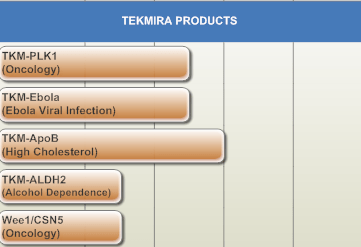

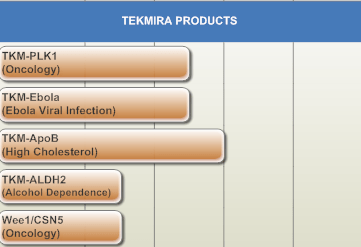

Burnaby based Tekmira, which was founded in 2005, is one of a handful of companies in the world developing therapies based on RNA interference, and the company is clearly an early leader in the space. RNA interference is a process that cells use to silence the activity of specific genes. The process works by blocking the molecular messengers of a a cell, rendering the cell useless. RNAi has already shown great potential with viruses such as HIV and Hepatitis C. Tekmira has three internal RNA interference product candidates; one to treat hypercholesterolemia, or elevated cholesterol, one for Ebola, and an anti-tumour drug in the treatment of cancer.

One of the curiosities clouding the Tekmira-Alnylam partnership is that Tekmira is actually suing Alnylam for trade secret misappropriation. Loe says the case, which is scheduled to be heard in Massachusetts court in October presents a “lingering risk” for Tekmira, but this risk is being offset by reduced clinical risk for all siRNAs.

Shares of Tekmira on the TSX closed Friday up 1.9% to $2.65.

_________________________________

__________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment