Between these two milestones can lie a rough and rocky road, fraught with false starts and frustration, especially for public companies, who must depend upon increasingly fickle capital markets.

Vancouver’s Zecotek Photonics (TSXV:ZMS), which dates its history back to 2004, is the brainchild of Dr. Faouzi Zerrouk, an English educated PhD in Theoretical Physics, who became a leading expert in photonics technologies.

Today, after investing more than $25 million in its technology, Zecotek owns title to or controls more than fifty-five patents and applications and is on the verge of commercializing its laser systems, high-performance crystals, solid-state photo detectors and other imaging and 3D display technologies. Recently, Cantech Letter’s Nick Waddell spoke with Zerrouk, who says Zecotek is now “open for business”.

Dr. Zerrouk, from reading your recent corporate update it seems that Zecotek is moving very close to commercialization. Where do you think your initial revenue might come from?

Let me first clarify the word commercialization. As you know we are a technology company that has been mostly focused on research and development. We don’t produce anything in house, so our revenue generating strategy depends upon third party contractors. We sub-contract the manufacture of our crystals and our detectors. Each of our divisions has a different revenue scheme. The one that is fluid, if you wish, the one with a more standard revenue model is imaging, so that is the one in which we would see revenues coming into the company in the classic way. The main commercial strategy is to partner with a much larger company that will integrate all the components that we have in imaging to make a module or that can be sold. But before we get to that stage, what we have done is we have broken the revenue streams down to crystals, photo-detectors, and data acquisition/read-out electronics, which are the three components of a Positron Emission Tomography, or a PET scanner.

For the crystals, we now have a partnership with a well established Chinese company, BOET, which has the capability of growing the crystals, so they can sell them to the end-user. The end-users are companies like GE and Philips, for medical imaging. Then of course you have all the research institutes, smaller integrators of PET scanners around the world. We also have a major application for high-energy physics at CERN, The Center for Nuclear Research and Particle Physics.

It sounds like you are ready to go on crystals.

We have opened the shop, as far as crystals are concerned. At this time, we have to position ourselves very carefully in order to gain as much competitive advantage as possible. We have done that by making sure our crystal technology was fully internationally patent protected and that it was a very robust crystal. You have to realize that is a tough industry, scintillation crystals, because this is a critical component of PET scanners, and it’s a very high volume product. We had to make sure that we had a unique crystal that was not only quality competitive but cost competitive. We made the decision to look for a quality Chinese partner that had access to the raw materials, because 95% of the raw materials are controlled by China. In this way we guarantee unique performance, stability, continuity, and cost certainty. So these are very important steps. We have achieved the necessary characteristics and we have secured the supply both on the raw materials side on the crystals manufacturing side. Now we are open for business.

Can you explain the importance of scintillation crystals to a layperson such as myself?

Sure. A PET scanner costs about a million dollars to make. One third of that cost is crystals. Economically, it’s a key component. The photo detectors are another third of that cost, and the data electronics is another third. Zecotek has all three components. As for the technology, the best way to describe that is to examine the moment a patient is pulled into a PET scanner. The patient is first injected with a radio trace element. That radio isotope has a trace of radioactive material, and the isotope has a glucose tag. A diseased tissue selectively uses the glucose. The healthy part of the body absorbs much less the radio isotope drug. Now, when that happens, there is an emission of gamma rays from the body. The gamma rays, or photons, are stopped by the crystal. The crystal absorbs these rays. When it absorbs them it, for lack of a better word “excites” the crystal. When the crystal relaxes it will emit visible light, a blue light. The blue light is captured by the photo detector because it is highly sensitive to this light. The light is then transformed by the photo-detector into an electronic signal. That signal is transformed into visual data through a series of electronic design schemes, such as a data acquisition board and readout configuration. The data is then displayed for medical examination. So the crystal plays a critical component because it captures the gamma ray and transforms it into light and ultimately into an electronic signal that can be read by a doctor. That is the function of a scintillation crystal.

Is this where you expect your first revenue stream to come from?

The immediate way for us to generate revenue is going to be through imaging. Our whole initial setup was developed for imaging. We have the manufacturing component there, and we have the developer. We have developed the manufacturing process in Malaysia, the Malaysian Institute for Micro-Electronics, or MIMOS. When we stabilized the process the institute, which is a government entity, realized the importance of the market. So knowing that, MIMOS expanded their facility and is now a full manufacturing plant with the capacity to produce our photo detectors. We have met all the performance parameters for both CERN and for PET scanners and that’s what we have been busy doing. Our detector is now seven to ten times cheaper than the old phototubes, it’s much more compact and it has very high performance. So really, it’s a no-brainer as far as the consumer is concerned. This is a revenue stream that has recently opened for business.

What about the deal you recently signed with NuCare Medical Systems of Seoul, Korea?

That company has the ability to manufacture our data acquisition and our read out electronics which, again, is a key component the PET scanner and many other gamma cameras. This is yet another revenue stream. It is not as aggressive as the crystals and the detectors, but nonetheless it is a component that can be sold. The data side of things is part of a three-pronged approach. When you put all three together; the data, the crystals and the photo detectors, these are the parts that comprise the PET systems. Therefore, instead of just sending them individually to be put together by someone else I decided that we might as well integrate all these and make our own PET scanners. But that would require financing. So I had to reach out to the emerging markets. There was no use in going to the Western World. I reached out to China and South America. We had to have a single financier for all of this. We are now in very advanced discussions with a government that is very keen on financings the development of the PET scanner for their own market, which is a substantial market. This is extremely exciting for us.

What happens until then?

Until then we will be selling the components separately. But as soon as we are able to finance and stabilize the production of the PET systems we will use our crystals a our detectors for our own market. In the meantime we will work with entities like CERN, which is a significant consumer of our components.

Can you tell us about your efforts in glasses-free 3D?

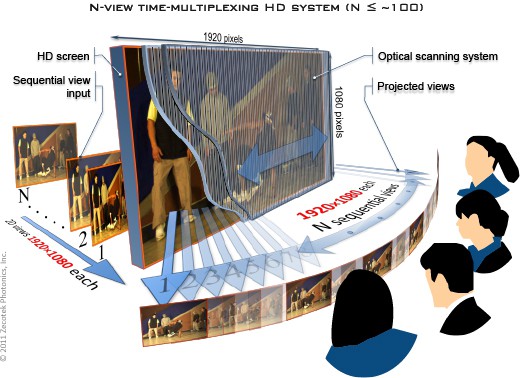

The 3D division is a much larger endeavor to commercialize than making crystals and detectors because this is a whole system, just like making a television and we are not into making televisions. The 3D technology is, without any exaggeration or overselling, the only solution to having a 3D display that is auto-stereoscopic, without glasses, and offers multiple views. More importantly, it preserves the resolution. There are other auto-stereoscopic systems without glasses, but they do not maintain the resolution. We are in advanced stages of discussions with several major companies in the TV and display space. So if that happens, the commercialization would follow a joint-development agreement, which would mean that the partner will actually spend the next eight months to a year on the project and finance it themselves. They would also provide personnel support. They would develop our 3D technology to a flat panel display for the consumer market. They will then take over the manufacturing and sales. When a big name takes over, it’s a guaranteed market. That would be the commercialization strategy for 3D. But we’re open to a profit-sharing scheme, licensing or an outright acquisition of that division.

What about your laser division? What can you tell us about the commercialization potential there?

It’s very much the same as the 3D. There is a critical need for a competitor to a company called IPG Photonics. This is a company that monopolizes the fiber laser market for material processing of all kinds, from low power to high power. In China, the laser marking market is exploding. IPG Photonics cannot meet the demand. An order today might be placed in a year. Our technology can easily rival IPG at least at the low and medium powers. We are capitalizing on this and leveraging our expertise to produce these lasers. We are working closely with Chinese companies to manufacture and sell our lasers. These lasers retail at approximately $10,000, and there is a critical demand for hundreds of thousand of lasers. So the revenue stream for the laser would take about ten months from the time we sign a deal, if we do.

You have a pretty impressive roster of patents built up. Are you prepared to go to court to defend them?

Absolutely. But I wouldn’t go to court if we had to pay for it ourselves, because that would be falling into the lion’s den. Big companies have very big pockets, and they are sued every day. They have budgets they allocate for these type of lawsuits. We will only go if we are represented by a litigation group that works on a contingency basis. I had to take some time to make sure that our patents are secured and we are well protected. The real question surrounding our patents is “Would we litigate?” The answer is yes. If someone, anyone, were to infringe on our technologies we are ready to go. We have well established legal firms behind us, who are ready to it on contingency. They have studied our patents and are determined when necessary.

What do you hope to accomplish in 2012?

I am really looking forward to taking Zecotek to the commercialization stage. I would like to close deals on all three of our divisions. This is really the time to do it. We have the technology, the market, the production facilities, the patents. We are in charge now and moving forward. It’s only a question of market positioning. We are making much progress with consumers, end users and OEM’s. We have equipped our shop, we will open the door by end of February and we are persuaded that the right people will come through. So in 2012, I want to get those people through and conclude our commercialization deal for the three divisions. I am very pleased to say that we are open for business now.

Disclaimer: Zecotek is a Cantech Letter sponsor.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment