But Byron Capital Healthcare analyst Douglas Loe says pay no attention to today’s financial results, and keep your eye on the company’s lead offering, CYT387.

Loe says “traditional income statement metrics are not yet material to YM’s valuation”. YM he says, is still heavily in the development stage with CYT387, which is its lead offering, and its EGFr-targeted Ab drug nimotuzumab.

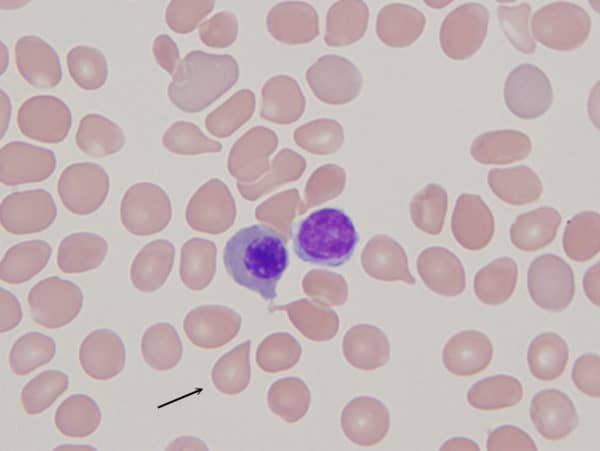

CYT387 targets the orphan bone marrow that causes Myelofibrosis, a disorder in which the bone marrow fails to produce enough new blood cells. Loe says there is no doubt the treatment has performed well enough in Phase Two trials to justify a Phase Three funding phase. The analyst says things could now start to get interesting for the company because he expects partnership interest to intensify.

_____________________________________________________________________________________________________________________

This story is brought to you by Verisante (TSX:VRS). The Canadian Cancer Society named Verisante Core a Top 10 Cancer Breakthrough of 2011. Click here for more information.

__________________________________________________________________________________________________________________

Although Loe points out that YM has $67.9 million, or about two years worth of cash in the bank, he says he is “cautiously optimistic that cash-contributing partner” could be in place before the end of the year.

Loe has a Buy recommendation on YM Biosciences with a one-year target of $5.25. He believes the company will begin to generate R&D milestone revenue of $22 million each year beginning this year. By 2017, he thinks, that revenue will be overshadowed by revenue from CYT387, which should generate $46 million that year, and Nimotuzumab, which he thinks will produce $39 million.

YM Biosciences was formed in 1994 and IPO’d in 2002 on the TSX and London’s AIM market. The company, which is now currently listed on the TSX and the AMEX in the US, has raised more than $120 million since it inception.

Share of YM Biosciences on the TSX closed Friday down 5.8% to $2.26.

________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

Comment

One thought on “Byron Capital’s Loe: Things Could Start to Get Interesting for YM Biosciences”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

test